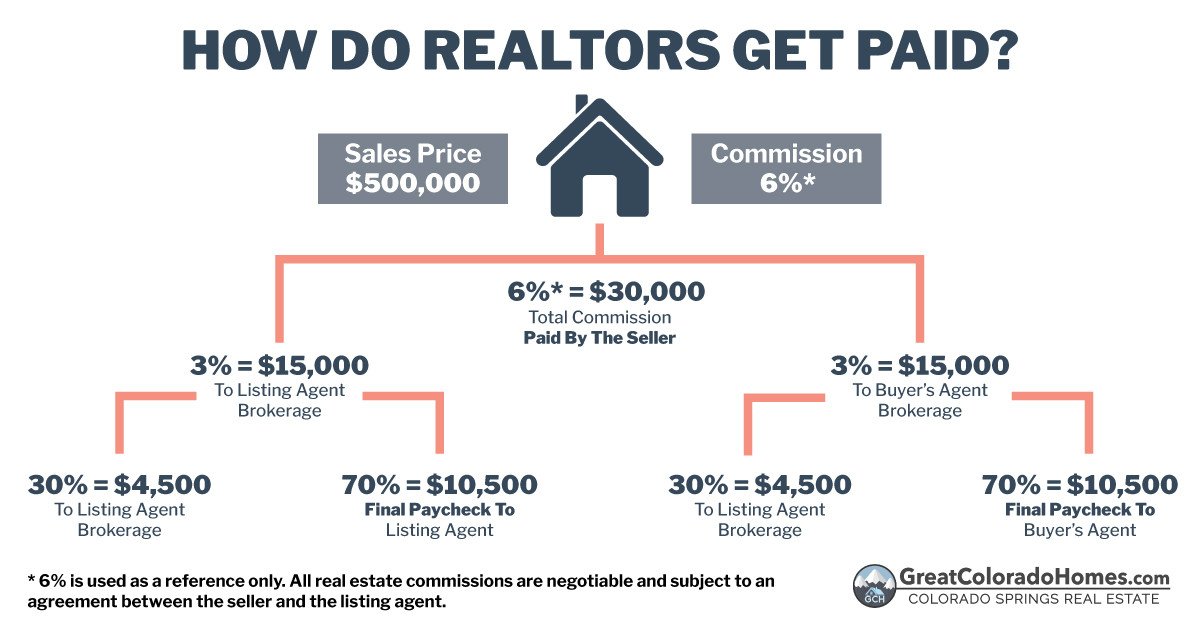

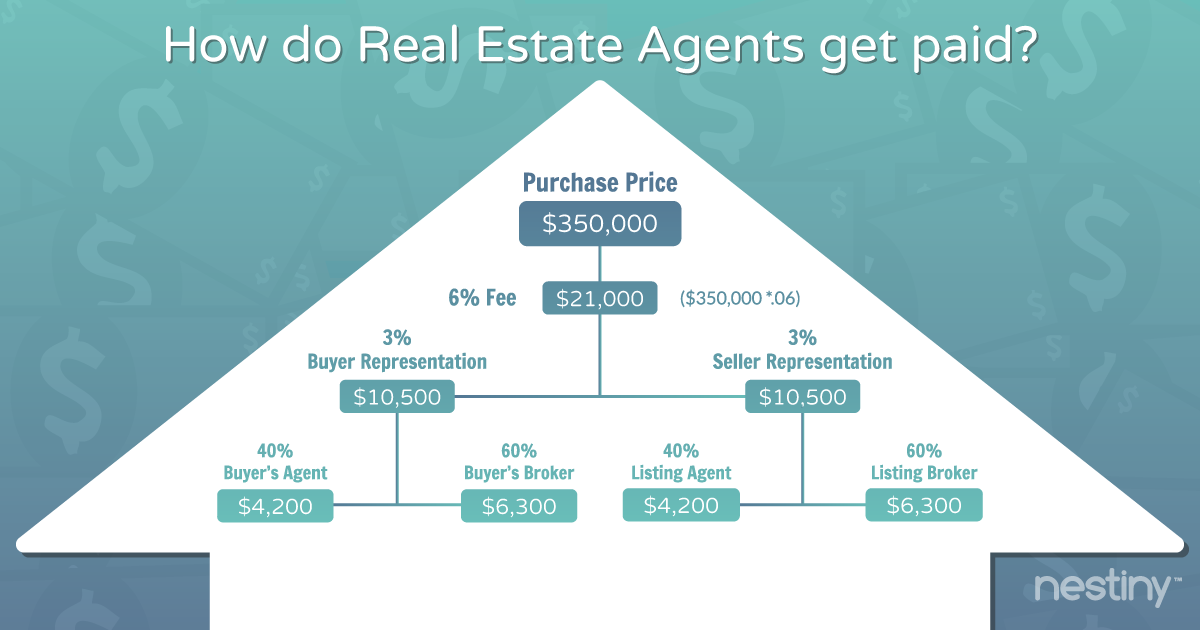

A common commission split gives 60% to the agent and 40% to the broker, but the split could be 50/50, 60/40, 70/30, or whatever ratio is agreed by the agent and the broker. It is common for more experienced and top-producing agents to receive a larger percentage of the commission.

Do buyers pay realtor fees in PA?

Once the sale is final, both realtors will split a commission fee which is calculated by the purchase price of the home. This fee is paid by the seller, but it is calculated into the overall cost of the home. So, once you make the transaction on the home or property sale, you've done your part in “paying” the agents.

What is the broker fee on top of commission?

The seller (the party selling the home) pays the listing or seller's agent the commission and splits the payment with the buyer's agent (the real estate broker representing the party buying a home). Broker fees usually range between 5% and 6% of the property's selling price but can be as low as 4% and as high as 7%.

Do buyers pay realtor fees in Michigan?

Who pays realtor fees in Michigan? In Michigan, home sellers pay real estate commission fees out of the final sale proceeds for both agents involved in a deal. Offering to pay for the buyer's agent's commission is an incentive for agents to show your home to their clients.

Why a broker is better than an agent?

The main difference between an agent and broker is the number of responsibilities they're able to take on. A broker can do everything an agent can do, but they have the added responsibility of making sure all real estate transactions are lawful, all paperwork is accurately completed and all finances are accounted for.

How do I decide between renting and selling?

- What are the Rental Prices in the Area?

- Do You Need the Equity From Your Current Home?

- What is the Market Like in Your Area?

- Will You Live in the House Again?

- Do You Have the Time and Money to Be a Landlord?

The National Association of Realtors just suffered an earthquake: The potential end of the 6% commission.

— Nick Martell 🦩 (@NickOfNewYork) November 2, 2023

Whether you’ve bought a home, sold a home, thinking of buying, thinking of selling, lived in a home, this story is for you.

But first, let's sprinkle on some context: The…

Why is selling better than renting?

For many homeowners the cost to carry a home is too high, and renting is simply not an option. A great deal of capital is necessary to purchase a new home, and by selling their current home they are easily able to raise that capital. The cash reserves necessary to own more than one home are also high.

Frequently Asked Questions

Is it better financially to rent or buy a house?

Buying a home is not a decision to take lightly. Generally speaking it costs more to own a home, at least in the short term, than to rent. That's why potential owners need to think about how long they will plan to stay in their newly acquired residence and whether that suits their long-term plans.

Is it better to sell a paid off house or use it as a rental?

What to think about before renting out your house?

- Treat Your Rental Property Like a Business.

- Find Tenants Online.

- Consider Hiring a Property Manager.

- Set the Right Rent Price.

- Create and Follow a Tenant Screening Process.

- Require a Rental Application.

- Require Renters Insurance.

- Require a Credit and Background Check.

What happens to your mortgage when you sell your house and don t buy another?

Hear this out loudPauseThe biggest point to remember when considering what happens to your mortgage when you sell your house is that the debt doesn't disappear when you sell the home. You'll still owe the money, even if you're planning on using the proceeds from the sale of your home to pay off the mortgage.

Should you Airbnb your house?

Hear this out loudPauseUpfront and ongoing expenses. An Airbnb rental may require higher upfront costs as the rental should be fully furnished and stocked. Ongoing expenses are also higher as you need to ensure that the property is always in perfect condition. This means that some of the items you will need to replace and restock regularly.

FAQ

- What is the 2% rule in real estate?

Hear this out loudPause2% Rule. The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

- What is the 5 rule for rent vs buy?

- Take the value of the home you are considering, multiply it by 5%, and divide by 12 months. If you can rent for less than that, renting may be a sensible financial decision. For example, you could estimate about $25,000 in annual, unrecoverable costs for a $500,000 home, or $2,083 per month. It goes the other way, too.

- What is it called when you buy a house fix it and sell it?

- Flipping is a real estate strategy that involves buying homes, renovating them, and selling them for a profit in a short period of time. Flipping houses is a business that requires knowledge, planning, and savvy to be successful.

- How do I decide between buying and renting?

The price-to-rent ratio: Take a monthly rent figure and multiply it by 12, so it's an annual number. Divide the purchase price of a similar property by that annual rent number. A ratio greater than 20 generally weighs in favor of renting, while a figure less than 20 generally favors buying.

- What is it called when a seller stays in the house after closing?

Both Parties Sign The Rent-Back Agreement

This legally binding document includes details such as the seller's rent and the length of time after closing that the seller can remain in the home. The rent-back agreement also includes the security deposit amount and additional insurance coverage or fees.

Who pays the broker fee in real estate

| When you sell your house do you keep the equity? | When the market value of your home is greater than the amount you owe on your mortgage and any other debts secured by the home, the difference is your home's equity. Selling a home in which you have equity allows you to pay off your mortgage and keep any remaining funds. |

| What should sellers leave for buyers? | This means window treatments (think: hardware, curtains, shutters and blinds), bathroom mirrors, shelving, door hardware, kitchen hardware and light fixtures. Unless you made an exception for these items in your contract, make sure to leave these home features behind for the new owners. |

| What is the disadvantage of rent back? | Cons Of A House Rent-Back The rent may be more expensive for the seller than their mortgage payment. If there's damage to the house, sellers may lose their security deposit. The buyer can't take possession of the house upon closing. The buyer ends up taking on landlord responsibilities. |

| What is the average equity in a home in 2023? | 2023 homeowner equity data and statistics The home equity stake of the average American homeowner with a mortgage is worth just over $274,000, as of the first quarter of 2023. In Q1 2023, the average homeowner lost $5,400 of home equity versus the first quarter of 2022. |

| What is the best time to rent your house? | The best time to rent a house is the summer. Peak rental season runs from May to August. In fact, applications increase by more than 50 percent over these months compared to the winter. There are several reasons people prefer moving in the summer. |

- What month do most people rent?

Peak rental season varies depending on where you live, but, generally speaking, it falls between May and September. That's when demand for rental properties is at its highest, so you can typically charge more during those months.

- What are the worst months to rent?

Rent is typically the most expensive from May to October, with September usually being the peak month for rental prices.

- What month is rent cheapest?

The lowest rental rates are found during the winter months—October through April—with demand and prices reaching their nadir between January and March. An apartment search should begin in the middle of the month prior to the target move month.

- What is the cheapest month of the year to rent?

Winter Months Are Best for Rental Savings

As the temperature drops, so do prices. The lowest rental rates are usually found between October and April, particularly right after the December holiday season. Fewer people are interested in moving—the weather's bad, schools are in session, etc.