Avoiding capital gains tax on your primary residence

You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years.

What are exceptions to the 2 year capital gains rule?

Exceptions to the 2-out-of-5-Year Rule

You might be able to exclude at least a portion of your gain if you lived in your home less than 24 months but you qualify for one of a handful of special circumstances such as a change in workplace, a health-related move, or an unforeseeable event.

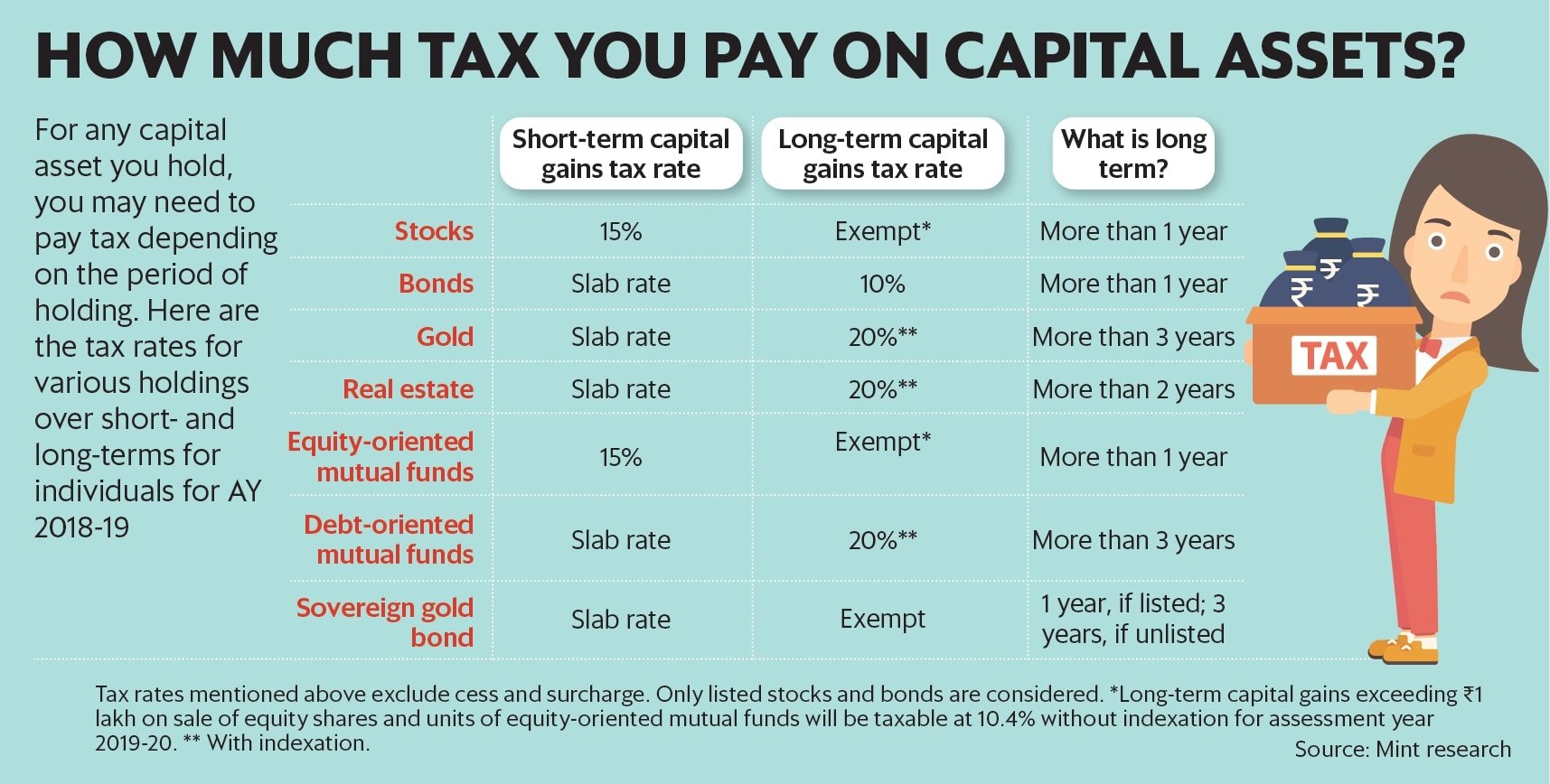

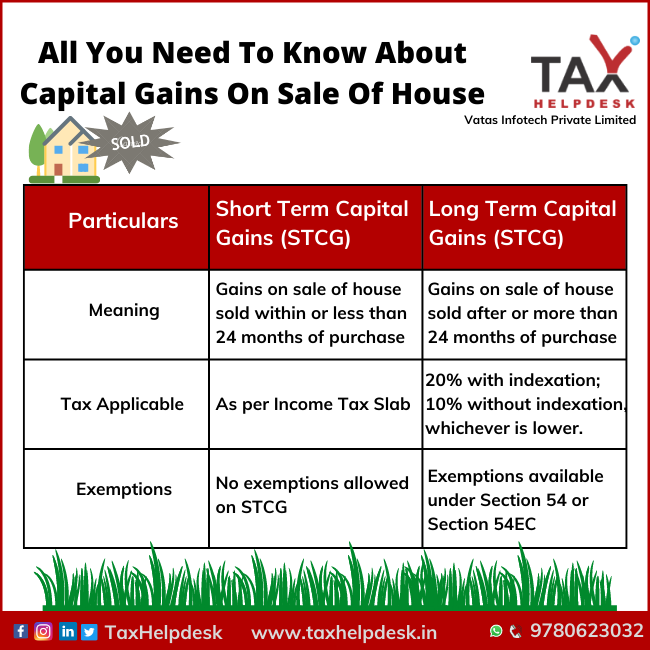

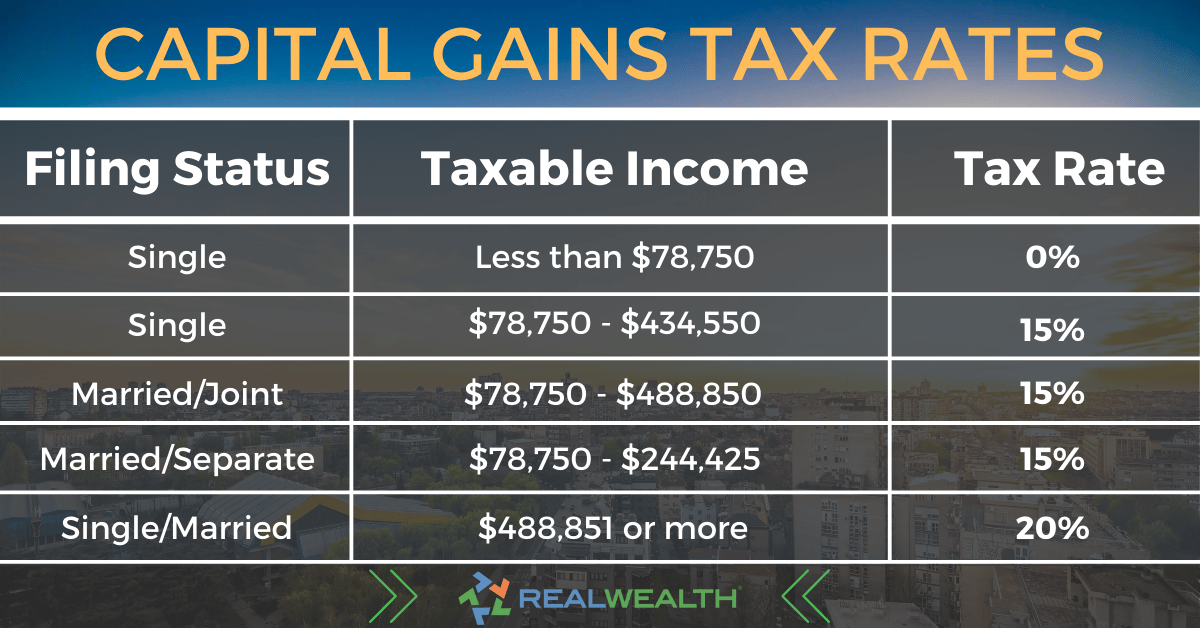

How long capital gains tax real estate?

What can you deduct from taxes when you sell a house?

Number six: You can reduce your taxable gain when you sell your home by deducting the total amount of your selling costs including real estate broker's commissions, title insurance, and more.

How do you beat capital gains tax on real estate?

- Own and live in your house for at least two years before you sell.

- Sell before your profits exceed the allowable exclusion.

- Sell before you file for divorce: If you're planning to get divorced, you may want to sell your home first.

Is renting a room taxable income?

Lots of people are trying to earn a few extra bucks by renting out a room in their home. As far as taxes go, this comes with bad news and good news. The bad news is that the rent you receive is taxable income that you must report to the IRS.

10) You just round-tripped $1M. Thanks for playing, enjoy the write off.

— Jack Raines (@Jack_Raines) January 24, 2022

You used margin? You can add debt on top of that. Bigger losses? You can't afford the bill.

The timing of sales and holding through EOY can have huge implications with Q1 bear markets.

Now RSUs (options).

How can I save money when renting a room?

- Get a Roommate. This one is obvious, and it will save by far the most money.

- Negotiate When You Renew a Lease. Landlords want to keep good tenants.

- Pay Upfront.

- Sign an Extended Lease.

- Give Up Your Parking Space.

- Look for Apartments in the Winter.

- Private Rentals.

- Consider a New Location.

Frequently Asked Questions

How does the IRS know if I have rental income?

First, if you deposit the rental payments into your bank account, the bank may send a 1099-MISC form to the IRS reporting the income. The IRS may also receive information from state and local governments about properties that are being rented out.

How long before a guest becomes a tenant in North Carolina?

North Carolina: Guests become tenants after occupying a property for 14 days. Ohio: Guests become tenants after occupying a property for 30 days. Pennsylvania: Guests become tenants after 30 days or after giving the landlord money to stay at the property.

What makes someone a tenant in NC?

(10) “Tenant” means any natural person or entity who is a named party or signatory to a lease or rental agreement, and who occupies, resides in, or has a legal right to possess and use an individual rental unit.

FAQ

- How do I evict someone from renting a room in my house in BC?

To evict a tenant in BC, the landlord must provide written notice to terminate the tenancy. Depending on the reason for eviction, the tenant's notice needs to be served at least 10 - 120 days before the termination date.

- How much can you make renting a room on Airbnb?

Average Annual Host Revenue by Room Count: 2021/2020

ROOM COUNT AVERAGE ANNUAL HOST EARNINGS 2021 AVERAGE ANNUAL HOST EARNINGS 2020 1 Room $8,586 $4,680 2 Rooms $13,067 $7,482 3 Rooms $18,026 $10,915 4+ Romss $28,143 $17,808 - How does spare room work?

SpareRoom is free to use. Anyone can post a Free Ad and contact all Bold Ads (blue), and other Free Ads (grey) more than 7 days old. To contact Free Ads less than 7 days old you'll need to upgrade to get Early Bird Access.

How long has house sale capital gains writeoff

| Is roommate rent taxable income? | If you own the house, then the roommate's payment is income. If you're only renting the property and your payment and your roommate's are used, together, to pay the rent to the owner, then it's not income. For more information, consult an accountant. | |||||||||||||||

| How much do Airbnb owners make a month? | Airbnb Owner Salary

|

|||||||||||||||

| How do I deduct rent for my home business? | Divide the square feet you use for your home workspace by the total number of square feet in your home to get a percentage. Multiply that number by the amount of your monthly rent to get the dollar amount you can write off from your taxes. |

- Is renting a room passive income?

Some of the simplest, most accessible ways to make money from passive income include: Rental income: Rent out a garage, room, or a house or apartment if you have it. This can be a short-term or longer-term arrangement.

- Do I have to report rental income from a family member IRS?

Thus, you would have to report all of the rent you receive in income, but none of your expenses for the home would be deductible. (Actually, you would still be able to deduct the mortgage interest, assuming it otherwise qualifies as deductible, and property taxes. These items are deductible even for non-rental homes.)