Any licensee who is a resident of the State of Florida and wishes to obtain a Georgia Salesperson or Broker license must take the supplement examination on Georgia Law and Practice in order to receive a Georgia license. Florida CAM licensees must take the Georgia CAM examination.

What state pays real estate agents the most?

The following are the 10 states where real estate agents earn, on average, the most money:

- New York: $111,800 (average real estate agent salary)

- Massachusetts: $84,180.

- Connecticut: $79,780.

- Alaska: $79,360.

- Colorado: $76,850.

- Utah: $75,170.

- California: $74,140.

- Texas: $72,830.

Can I use my GA real estate license in Alabama?

The eight states with mutual recognition agreements are: Alabama, Arkansas, Connecticut, Georgia, Illinois, Mississippi, Nebraska, and Rhode Island. If you hold a real estate license in a state other than one of these eight, you will need to take the entire exam.

Can I use my California real estate license in Texas?

Answer: No. Texas does not have reciprocity with any state. To become licensed, you must satisfy all current Texas licensing requirements.

Can I get a Florida real estate license if I live in another state?

Yes. If you live outside Florida, you may still apply for a Florida real estate sales associate license. As a nonresident, you will need to meet the same eligibility, education and exam requirements as a resident, unless you live in one of the eight states in which Florida has real estate licensing reciprocity.

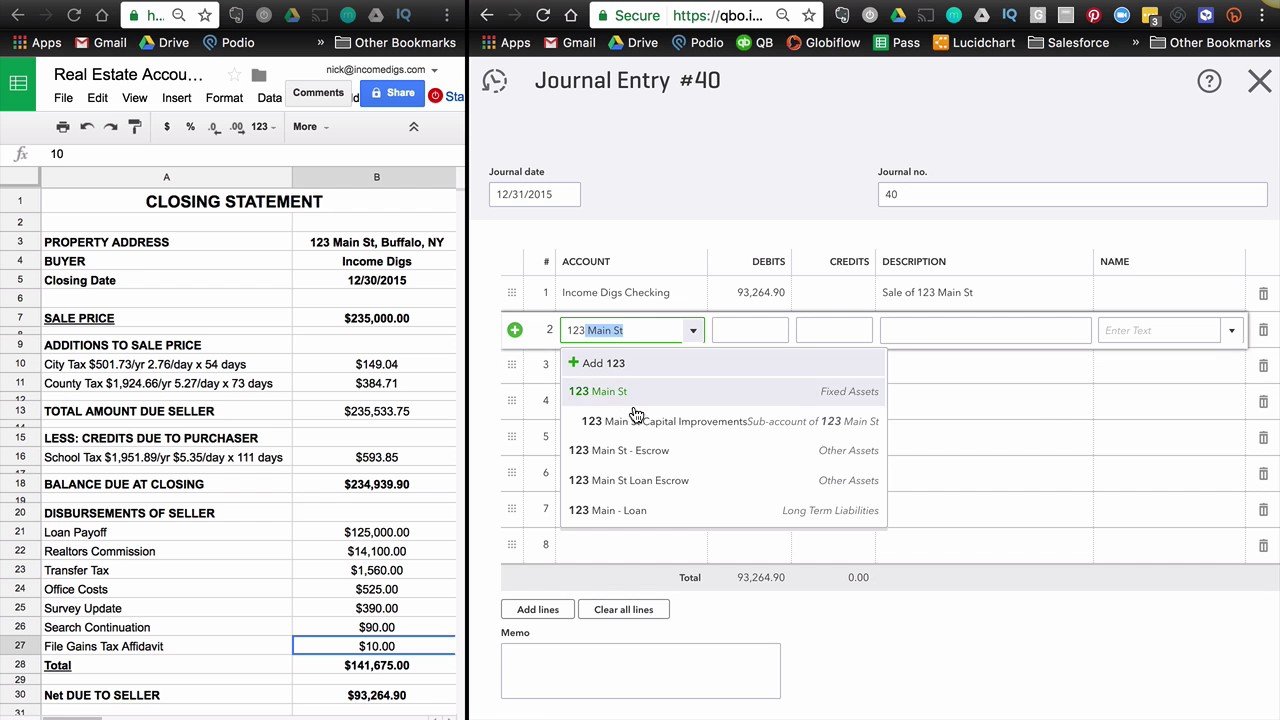

Where do I report the sale of a second home in TurboTax?

You need TurboTax Premier to report the sale of a second home. To report the sale : Go into the Wages and Income section of your return, Scroll down to Investment Income.

Finding the Perfect Buyer: A Real Estate Rollercoaster *short story, happy ending*

— Tory Sheffer (@ToryJSheffer) July 17, 2023

We sold a property last month. Went on the market officially in September of 2022. Hindsight, worst timing ever to hit the market.

We had verbal agreements with 4 buyers before the 5th followed… pic.twitter.com/NmA9nimEjQ

What is the IRS tax on the sale of a second home?

If you sell property that is not your main home (including a second home) that you've held for more than a year, you must pay tax on any profit at the capital gains rate of up to 20 percent.

Frequently Asked Questions

Can I deduct a loss on the sale of my second home?

Losses from the sale of personal–use property, such as your home or car, are not deductible.

Are California property records public?

California state law prohibits the publishing of identifying information like a homeowner's name online without written permission from the owner. Property ownership information can be requested from the County Registrar-Recorder/County Clerk.

How do I find out who owns a property in Pennsylvania?

As long as you know the address of a property, you can find more information about it by contacting the county clerk's office. The specific way that you do this varies by location. Some counties have online databases that you can search. Others require you to call their offices to request property information.

Are property records public in Texas?

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records".

How do I find out who owns a property in Missouri?

Online

- Visit the Address & Property Search page.

- Enter the property's address or parcel ID.

- View the owner information under "Basic Info"

How do I find out who owns property in Tennessee?

In Tennessee, the county register records land transactions, including deeds. To find out the names of Tennessee landowners, you can either visit the county courthouse and ask the register's office to run a deed search for you or, in some counties, you can run this search online.

Are property sale prices public record in Texas?

Are home sales prices public record in Texas? Nope, they are not! Texas is a non-disclosure state. Home sale prices are not public records.

How do I look up property records in Florida?

Most records are searchable and accessible through the internet from the Board of Trustees Land Document System (BTLDS). A mapping component of BTLDS also provides a graphical depiction of parcel locations. These documents are stored in a climate-controlled vault.

How do I look up a property deed for Tennessee?

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee).

Are property records public in Colorado?

Unless specifically outlined in Colorado statute, all Division of Real Estate (the "Division") and Department of Regulatory Agencies ("DORA") documents are open to the public and can be requested at any time.

How do I find out if someone owns a property in Colorado?

Ownership can be determined by either contacting the county assessor by telephone and requesting the information, telephoning the 24 hour automated system, using the assessor / GIS search on our website or by emailing your request to the assessor.

How do I find public records in Colorado?

Public records in Colorado are available online, although some records may be restricted. If this happens, you need to send a written request by mail or email to the specific government agency or office with the public records you need. However, private sources can also provide access when the records are available.

Does selling a vacation home count as income?

Your profit will be treated as a capital gain and taxed accordingly. If you've owned the property for more than one year and never rented it out, you'll owe federal capital gains tax at the lower rates for long-term capital gains.

How do I report a sale of property on Schedule D?

To start you must report any transactions first on Form 8949 and then transfer the info to Schedule D. On Form 8949 you'll note when you bought the asset and when you sold it, as well as what it cost and what you sold it for.

Is a loss on the sale of a vacation home tax deductible?

A second home, or a timeshare, used as a vacation home is a personal use capital asset. A gain on the sale is reportable income, but a loss is NOT deductible. You may receive IRS Form 1099-S Proceeds from Real Estate Transactions for the sale of your vacation home.

How do I report the sale of a vacation home?

Your second residence (such as a vacation home) is considered a capital asset. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets to report sales, exchanges, and other dispositions of capital assets.

FAQ

- How do I look up property records North Carolina?

- To look at a deed you can:

- Go to your Register of Deeds Office and look at the document there. Find your Register of Deeds in: Your phone book under county government. The NC Directory of State and County Officials:

- Look it up online. Many counties have their real property (land) records online. Go to the county website.

- Are records public in North Carolina?

- North Carolina's public records law provides a broad right of access to records of public agencies. The main statutes that define the scope of the law are contained in Chapter 132 of the North Carolina General Statutes (hereinafter G.S.).

- What can I deduct on the sale of a second home?

- Any money you invested to renovate or repair your second home can be deducted from the profit. If you put in a new roof for $10,000, then your taxable gain is down to $90,000. You can also deduct costs associated with the purchase and sale of your second home. Realtor commissions, inspections, origination fees, etc.

- How do I avoid capital gains tax on my second home?

- A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

- What are the IRS rules for second homes?

- For the IRS to consider a second home a personal residence for the tax year, you need to use the home for more than 14 days or 10% of the days that you rent it out, whichever is greater. So if you rented the house for 40 weeks (280 days), you would need to use the home for more than 28 days.

- Is it better to have a second home or investment property for taxes?

- Investment properties can offer you tax deductions by claiming operating expenses and ownership. Second homes, on the other hand, can also generate rental income and tax deductions for expenses, as long as the owner lives there for at least 14 days a year or 10% of the total days rented.

- Does sale of investment property go on Schedule D?

- Schedule D is used to report gains from personal investments, while Form 4797 is used to report gains from real estate dealings—those that are done primarily in relation to business rather than personal transactions.

- How do I report sale of second home on Schedule D?

- Your second residence (such as a vacation home) is considered a capital asset. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets to report sales, exchanges, and other dispositions of capital assets.

- Where do you put sale of second home on tax return?

- Your second residence (such as a vacation home) is considered a capital asset. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets to report sales, exchanges, and other dispositions of capital assets.

- How do I report the sale of my home in TaxAct?

- From within your TaxAct return (Online or Desktop), click Federal (on smaller devices, click in the top left corner of your screen, then click Federal). Click the Investment Income dropdown, click the Gain or loss on the sale of investments dropdown, then click Sale of your main home.

- Should I use Form 8949 or 4797?

- Should You Use Form 8949 or Form 4797? When reporting gains from the sale of real estate, Form 4797 will suffice in most scenarios. Form 8949 will need to be used when deferring capital gains through investments in a qualified fund.

- How do I record the sale of a second home on my taxes?

- Your second residence (such as a vacation home) is considered a capital asset. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets to report sales, exchanges, and other dispositions of capital assets.

- Can you deduct capital loss on sale of second home?

- A second home, or a timeshare, used as a vacation home is a personal use capital asset. A gain on the sale is reportable income, but a loss is NOT deductible. You may receive IRS Form 1099-S Proceeds from Real Estate Transactions for the sale of your vacation home.

- How do I report a sale of a house on 8949?

- As you complete Form 8949, you'll need a few different pieces of information, including the date you acquired the property, the date you sold the property, the sales price (amount the property was sold for), and the cost or other basis (amount you paid for the property plus any fees or commissions).

- Is sale of a second home taxable?

- If you sell property that is not your main home (including a second home) that you've held for more than a year, you must pay tax on any profit at the capital gains rate of up to 20 percent.

Where can i find a record of house sale

| Where do you put sale of home on tax return? | Reporting the Sale Report the sale or exchange of your main home on Form 8949, Sale and Other Dispositions of Capital Assets, if: You have a gain and do not qualify to exclude all of it, You have a gain and choose not to exclude it, or. You received a Form 1099-S. |

| Are Florida property records public? | public record. |

| How do I look up property owners in Florida? | Contact the County Clerks Office As long as you know a property's location, you can contact the county clerk's office to learn more about the owner. Florida has 67 counties. It's fairly easy to narrow down a property's county even when you have limited information about the location and tenants. |

| Can a realtor do business in another state? | If you're a real estate agent in Georgia and would like to do business in other states, you're in luck. Georgia has reciprocity agreements with every state in the U.S. That means you don't have to take all of your pre-licensing education hours again. |

| Does Florida accept out-of-state real estate license? | If you already hold a real estate license from another state, you have few options to obtain your real estate license in Florida. Florida has mutual recognition with 10 states: Alabama, Arkansas, Connecticut, Georgia, Illinois, Kentucky, Mississippi, Nebraska, Rhode Island and West Virginia. |

| Does Arizona recognize out-of-state real estate license? | Individuals in Arizona who are seeking to qualify for Arizona's Out-of-State License Recognition, according to the Arizona Department of Real Estate (ADRE), must: Be an Arizona resident. Be currently licensed in another state and have held that license for at least one year. |

| Can a Florida realtor sell anywhere in Florida? | My Florida Regional MLS is the largest MLS in Florida and currently serves 17 Realtor® Boards/Associations. Agents are not limited to this geographic range as they can enter listings anywhere in Florida, but these are the 17 boards where Realtors® have access to their listings. |

| Where to find house sale records | Real estate property record search, claim your home, find house records, property history, estimated prices, photos and more! |

| Is sale second home loss deductible? | A second home, or a timeshare, used as a vacation home is a personal use capital asset. A gain on the sale is reportable income, but a loss is NOT deductible. You may receive IRS Form 1099-S Proceeds from Real Estate Transactions for the sale of your vacation home. |

| Does sale of land go on 4797 or Schedule D? | Whereas Schedule D forms are used to report personal gains, IRS Form 4797 is used to report profits from real estate transactions centered on business use. IRS Form 4797 has much more specific utilization, while Schedule D is a required form for anyone reporting personal gains in general. |

| Does sale of primary residence go on Schedule D? | Sale of Your Home You may not need to report the sale or exchange of your main home. If you must report it, complete Form 8949 be- fore Schedule D. the sale or exchange. Any gain you can't exclude is taxable. |

| Who is responsible for filing a 1099s after closing? | Who files the Form 1099 for a real estate sale? According to the IRS, the person who must file the Form 1099-S reporting the sale is the person responsible for closing the transaction. |

| How do you calculate capital gains on the sale of a second home? | Capital Gains Taxes on Property Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. You can also add sales expenses like real estate agent fees to your basis. Subtract that from the sale price and you get the capital gains. |

| How do you check if a property is sold? | Any official sold figures will come from HM Land Registry, so if you're looking for information about one specific property the Land Registry website is a great place to start. If you're looking for a general overview of sold prices in a wider area, you might find websites such as Rightmove or Zoopla useful. |

| What does title absolute mean? | An absolute title to a property (also known as a perfect title) is free of any encumbrances or deficiencies. An absolute title gives an unequivocal right of ownership to the owner and cannot be disputed or challenged by anyone else. |

- Can you see when someone bought a house?

- Finding sales history online The recorder's office will likely have both electronic and paper files for you to search. The records should indicate who previously owned the home, how much they paid for it, when they bought it, and the current owner's remaining mortgage bill (if applicable).

- Are property deeds public record in Missouri?

- About Us. The Office of the Recorder of Deeds maintains public records and documents, including those pertaining to land ownership, federal and state tax liens, marriages, and military discharges.

- Can I see who bought the house next to me?

- Check the local tax assessor's office So, if you're wondering who owns that property next door, the best place to start is by going to your local tax assessor's office. Assessors provide free, easy, and comprehensive ownership data for every registered property in their county.

- Can a Florida real estate agent sell in Georgia?

- The answer is yes! Unless you're coming from Florida, you can apply for a reciprocal Georgia license without taking the Georgia salesperson exam. If you're a Floridian, you've got to do a little extra to get your Georgia license, but it's not impossible. Here's how it works.

- Can I use my Ohio real estate license in another state?

- The Ohio Division of Real Estate and Professional Licensing has reciprocity agreements with the following states: Arkansas, Connecticut, Kentucky, Mississippi, Nebraska, Oklahoma, West Virginia and Wyoming. Please click on the attachment to download the Salesperson Reciprocity Application.

- Where do I enter the sale of a second home in TurboTax?

- Open your TurboTax account > Wages & Income.

- Scroll to Investment Income > Select Stocks, Mutual Funds, Bonds, Other > Start or Update.

- Select the type of sale (see image below)

- Enter the details of the property sold - Select Second Home from the dropdown continue to enter your information.

- Continue to finish your sale.

- Where do I record sale of home on tax return?

- Per IRS Instructions for Schedule D, if you sold or exchanged your main home, do not report it on your tax return unless your gain exceeds your exclusion amount. Any gain not excluded is taxable and reported on Form 8949 Sales and Other Dispositions of Capital Assets and Schedule D (Form 1040) Capital Gains and Losses.

- Does sale of second home go on form 4797?

- If the second home was used for rental purposes, or if you previously claimed depreciation on the property, the sale would be reported on Form 4797 Sales of Business Property.

- Should I use form 8949 or 4797?

- Should You Use Form 8949 or Form 4797? When reporting gains from the sale of real estate, Form 4797 will suffice in most scenarios. Form 8949 will need to be used when deferring capital gains through investments in a qualified fund.

- What IRS form do I use to report the sale of real estate?

- Form 1099-S Use Form 1099-S to report the sale or exchange of real estate.

- How do I report the sale of a second home on my taxes?

- Your second residence (such as a vacation home) is considered a capital asset. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets to report sales, exchanges, and other dispositions of capital assets.

- Can I use my Florida real estate license in North Carolina?

- Does North Carolina have real estate license reciprocity with any other states? North Carolina does not have a formal reciprocity arrangement with any other states. However, out-of-state agents can speed up the North Carolina licensing process by getting the education portion waived.

- Can I use my NJ real estate license in NY?

- New York does not offer reciprocity with New Jersey; however, the DOS may waive the 77-hour New York Real Estate Pre-Licensing Course requirement if you can show evidence that you have completed the New Jersey real estate pre-license course.

- What states accept FL real estate license?

- Florida has mutual recognition with 10 states: Alabama, Arkansas, Connecticut, Georgia, Illinois, Kentucky, Mississippi, Nebraska, Rhode Island and West Virginia.

- How do you search history of a house?

- To help you in your quest for property knowledge, here are nine ways to find out the history of your house and the land it sits on:

- Bureau of Land Management, General Land Office.

- Local assessor's office.

- Census records.

- Local library or historical society archives.

- DiedInHouse.com.

- Local history books.

- HouseNovel.

- To help you in your quest for property knowledge, here are nine ways to find out the history of your house and the land it sits on: