Since Real Estate Property Taxes are paid in advance you will most likely be reimbursing the seller. Real Estate Property Taxes are paid in January and July so if the annual tax bill for your home is $3,600 that breaks down into 2 payments of $1,800.

How do real estate taxes work in Connecticut?

Connecticut Property Tax Rates

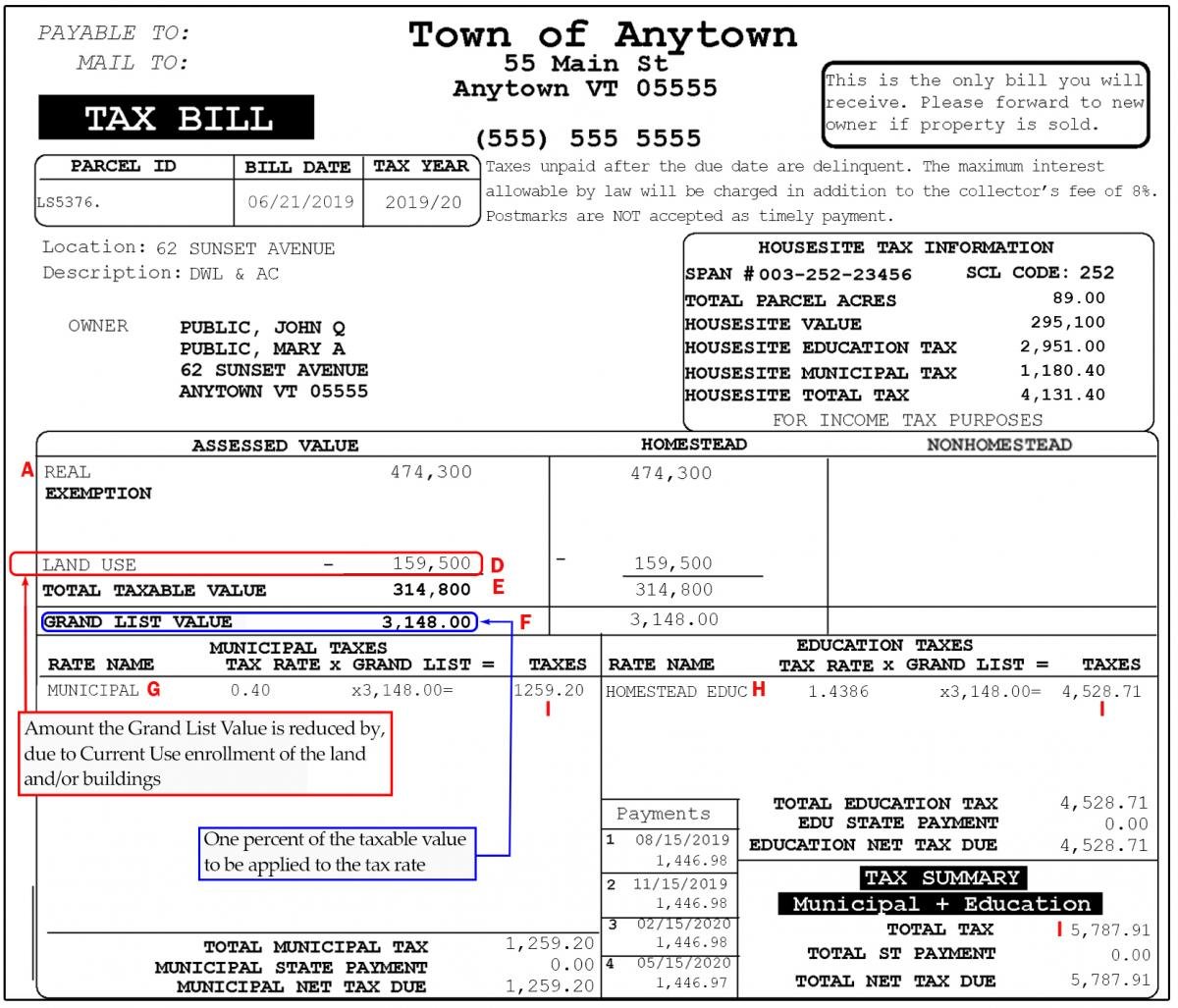

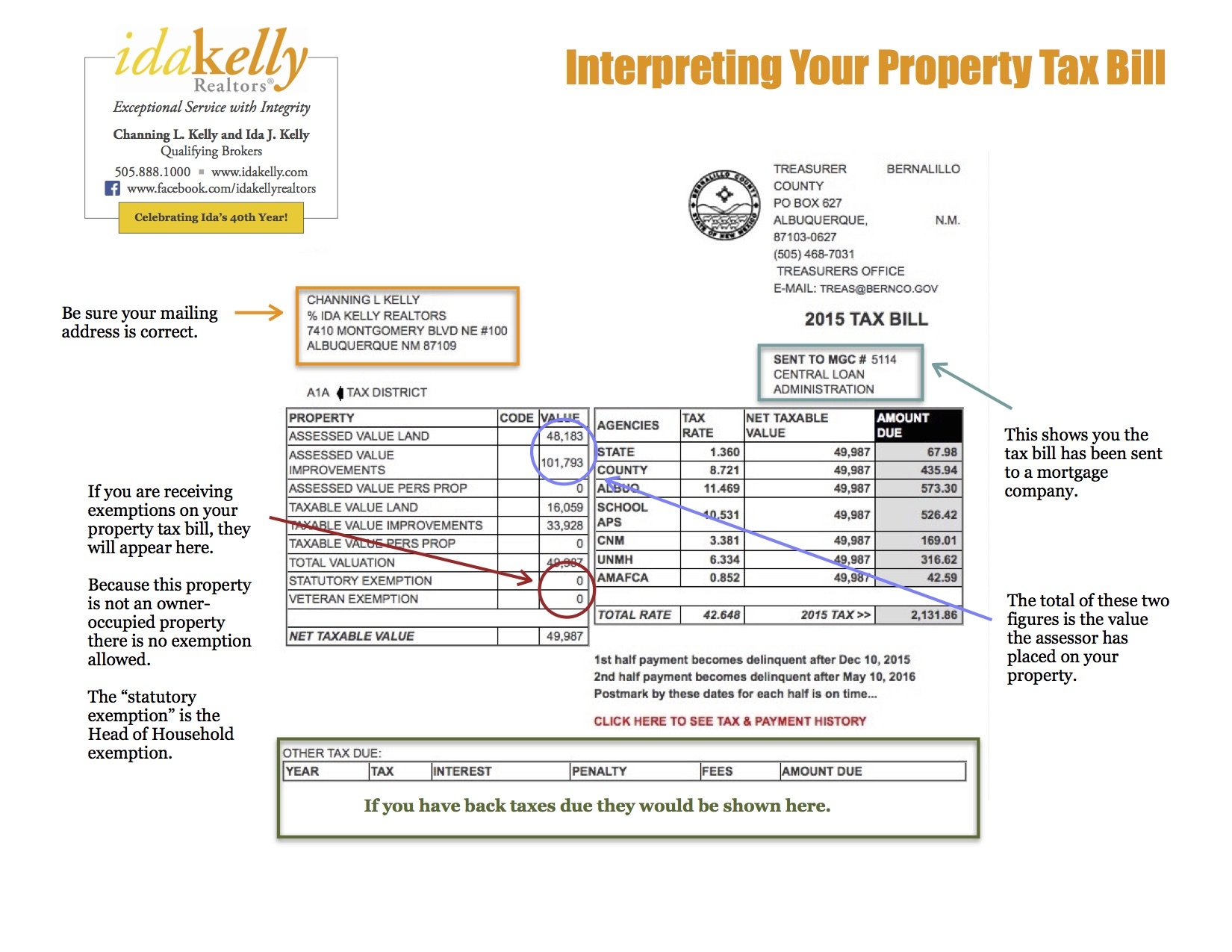

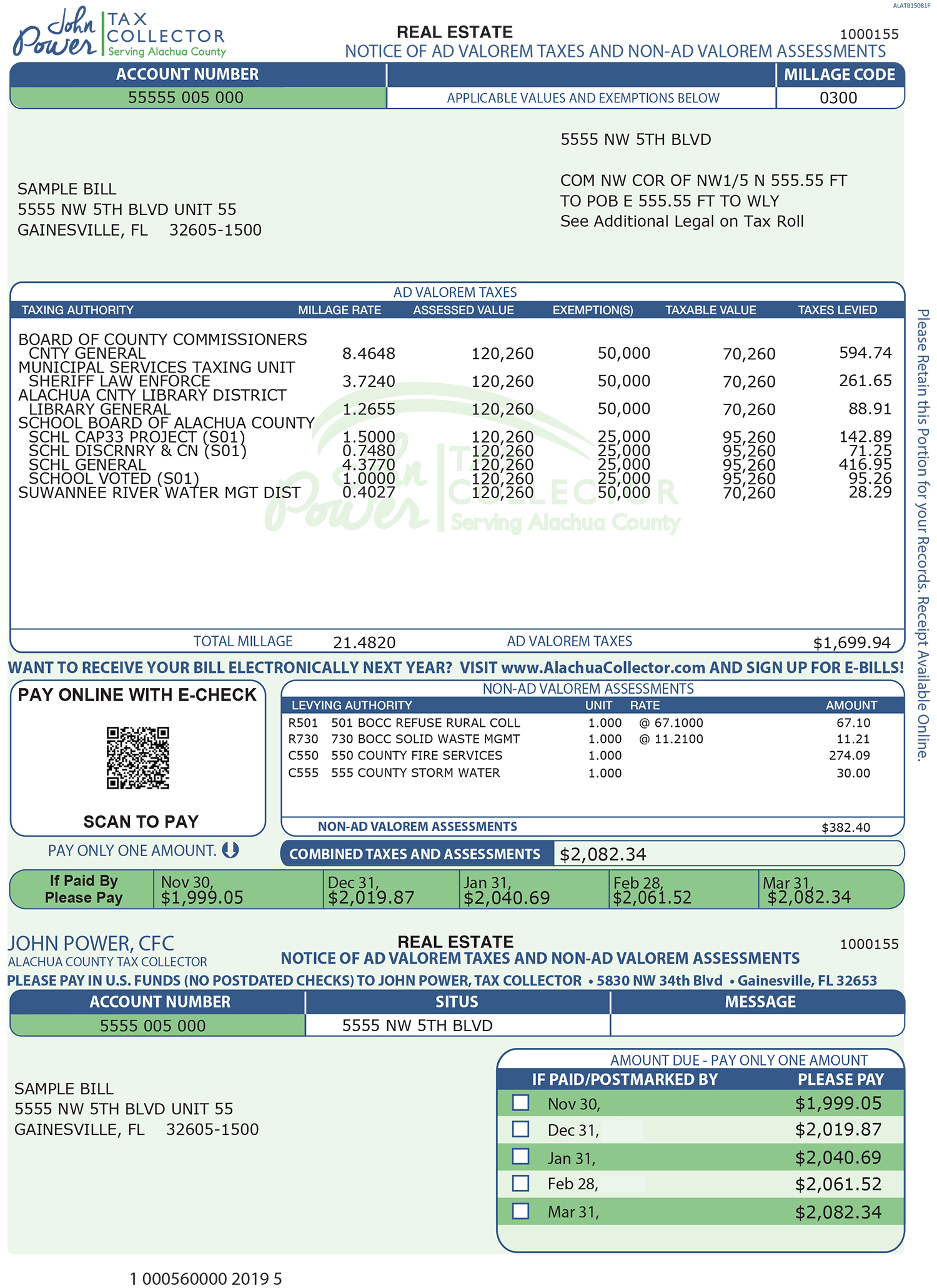

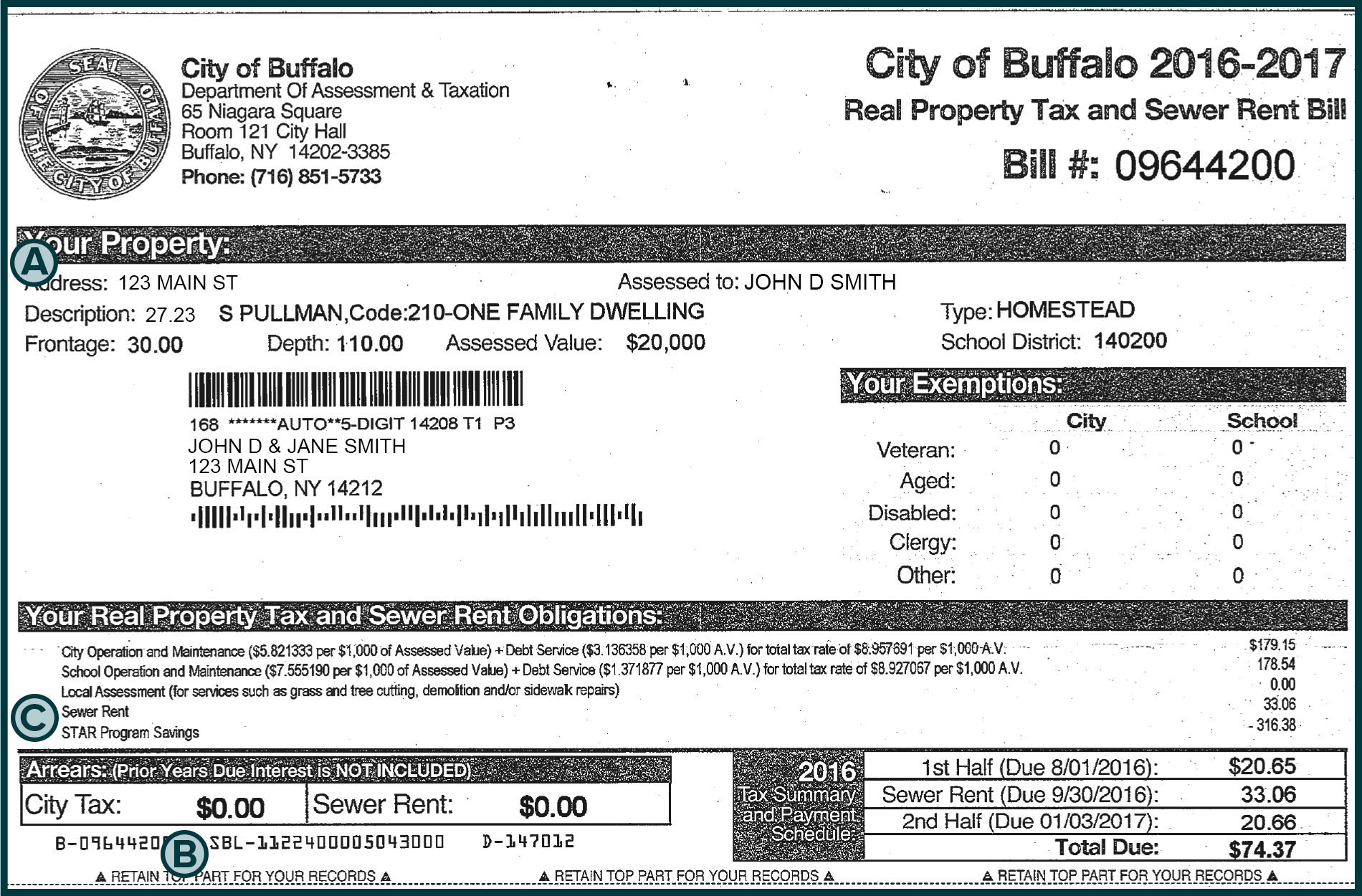

Municipalities in Connecticut apply property taxes in terms of mill rates. A mill rate is equal to $1 in taxes for every $1,000 in assessed value. To calculate your tax based on your mill rate, divide your assessed value by 1,000 and multiply the result by your mill rate.

What is the property tax period in CT?

Real Estate and Personal Property taxes are due semi-annually, on July 1st and January 1st. There is a 30 day grace period from the due date, meaning payment can be made 30 days from the due date without incurring interest at a rate of 18% per year.

How often do you pay property tax on car in CT?

Regular Motor Vehicle taxes are due in one installment on July 1st. These taxes are on vehicles registered as of the previous October 1st and cover October 1st of the previous year through September 30th of the current year. Supplemental Motor Vehicle taxes are due in one installment January 1st.

What home improvements increase property taxes in CT?

If you have made considerable improvements to your home by renovating it or building an additional structure, such as a garage, you can expect to pay more on your property taxes. That's because these improvements will increase the value of the property, which has a direct impact on your taxes.

Is there a grace period for property taxes in CT?

A 30-day

State law provides a 30-day grace period for a property tax payment (Chapter 204 - Sec. 12-142). If a taxpayer pays a tax after the 30-day grace period, the payment is delinquent.

Few examples could be: Place of supply of training done in physical presence outside India, accommodation/food consumed outside, travel done outside India, services performed physically on goods outside India, transport of goods destination outside India, Trade event/exhibition…

— CAclubindia (@CAclubindia) May 15, 2023

How high are property taxes in Connecticut?

The average property tax rate in CT for 2023 is $30.50, with the highest being Hartford at $68.95 and the lowest being Salisbury at $11.

Frequently Asked Questions

Why are property taxes so high in CT?

Due to the lower value of their taxable property, Connecticut's less affluent communities frequently have higher mill rates in order to generate the property tax revenue they need to fund their local schools and public services.

Is property tax based on purchase price in Connecticut?

What town in CT has the lowest property taxes?

Salisbury

Salisbury has a mill rate of 11, which is among the lowest for a municipality in the state. Property in Connecticut is assessed at 70 percent of fair market value, except in Hartford, which has different assessment rules for commercial and residential property.How is real property value and assessed for tax purposes in Connecticut?

In Connecticut, an assessment is equal to 70% of a property's estimated Fair Market Value as established by the Assessor in a revaluation year. Real estate revaluations are performed on a periodic schedule, established by State Law.

How often are properties reassessed in Connecticut?

Every five years

Revaluation is the process for measuring and capturing changes in property values. Per the General Statutes of the State of Connecticut (§12-55 & §12-62(f), a revaluation must be completed every five years.

What happens if you don't pay property taxes in CT?

Do you pay property taxes monthly or yearly in Connecticut?

FAQ

- How often do you pay property taxes in CT?

Real Estate and Personal Property taxes are due semi-annually, on July 1st and January 1st. There is a 30 day grace period from the due date, meaning payment can be made 30 days from the due date without incurring interest at a rate of 18% per year.

- Who pays property taxes in CT?

Ownership of property on an assessment date makes a taxpayer liable for property taxes, unless the property is exempt from taxation. Certain property may also be subject to taxation if located in any Connecticut municipality for a specific period of time prior to an assessment date (Chapter 203 - Sec.

- Why are CT property taxes so high?

- Due to the lower value of their taxable property, Connecticut's less affluent communities frequently have higher mill rates in order to generate the property tax revenue they need to fund their local schools and public services.

- Is it better to invest or buy a business?

So if you're short on time but still want to make money, investing may be the better option for you. However, if you have more free time and are looking for a long-term investment, starting a business could be the right choice. Evaluate your own personal resources and goals to see which option fits best for you.

- Which type of real estate business is most profitable?

- Commercial properties are considered one of the best types of real estate investments because of their potential for higher cash flow. If you decide to invest in a commercial property, you could enjoy these attractive benefits: Higher-income potential.

- Is it better to invest money or buy real estate?

Stock investing may be a more effective approach for those wanting higher returns over a shorter period. Real estate may be ideal for those who want a stable flow of income who can wait to see a return on their investment. Risk tolerance. Stock and real estate investing carry various levels of risk.

- Is it a good idea to buy an existing business?

Higher upfront purchasing costs

By buying an existing business, you'll be able to save money on operating costs, such as inventory and equipment. However, you'll probably face some pretty sizable purchasing costs. In fact, those purchasing costs might be greater than what it would take you to start a new business.

When does my real estate tax bill cover in ct

| Is it smart to own a small business? | Financial gains Although owning a business comes with financial risks, you also reap the financial rewards. If you do not have a business partner or employees, you don't have to worry about paying them. If you have only a few employees, that means fewer people take a cut of your earnings. |

| Does CT have the highest property taxes? | The per capita property tax burden in Connecticut is $3,215, well above the national average of $1,758 and the 3rd highest in the nation. |

| What is the tax on a house sale in CT? | In Connecticut, sellers are typically responsible for paying real estate commissions (usually around 6 percent of the purchase price in total) and a conveyance tax that ranges between 1 and 2.75 percent of the purchase price. |

| How do Connecticut property taxes work? | Once the appraised value is completed, the property is taxed based on its assessed value, which is 70% of the property's appraised value. The assessed value of the property is then divided by the individual town's mill rate, which is a shorthand calculation equivalent to $1 for every $1,000.00 of assessed value. |

| Which tax is determined by property value? | Property tax Property tax is a tax levied by your local and state governments. It's based on the value of your property. The tax proceeds are used to cover taxpayer services, like public schooling and fire, police and public safety. |

| What is the difference between real property and personal property example? | Real property includes land plus the buildings and fixtures permanently attached to it. Real property taxes are assessed on agricultural, commercial, industrial, residential and utility property. Personal property is property that is not permanently affixed to land: e.g., equipment, furniture, tools and computers. |

| What is not an example of personal property? | Expert-Verified Answer The term that is NOT an example of personal property is the "One acre of farmland". What is personal property ? Personal property refers to property that is moveable and not permanently fixed to land. It includes things like furniture, clothing, vehicles, and money. |

- What are 4 examples of property?

The most common types of property are real, private, government-owned, and personal property.

- What's the difference between private property and personal property?

Private property is owned by a private individual or group of private individuals. It is generally land and/or real property. Personal property is those things owned by a specific individual, be those items land, money, jewelry, electronics, or sex toys.

- What are the 3 types of personal property?

Personal property can be characterized as either tangible or intangible. Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Stocks, bonds, and bank accounts fall under intangible personal property.

- How real estate taxes are paid in connectcit

To calculate the property tax, multiply the assessment of the property by the mill rate and divide by 1,000. There are different mill rates for different towns

- How is the estate tax calculated in CT?

In Connecticut, the tax rate for deaths prior to 2023 ranged from 10.8 to 12% depending on the size of the estate. Starting in 2023, the Connecticut estate tax is a flat-rate tax of 12%. (Compare these rates to the current federal rate of 40%.)

- How often do you pay property tax in CT?

Real Estate and Personal Property taxes are due semi-annually, on July 1st and January 1st. There is a 30 day grace period from the due date, meaning payment can be made 30 days from the due date without incurring interest at a rate of 18% per year.

- What is the estate tax rate in CT 2023?

12%

The estate tax rate used to be progressive and payable on the value of the entire taxable estate. The tax rate ranged from 11.6% to 12% for 2022. In 2023, there will be a flat rate of 12%.