2023 tax year: 27.9% of the actual property value, minus the $30K reduction. MULTI-FAMILY: 2023 tax year: 6.765% of the actual property value, minus the lesser of $15,000 or the amount that reduces the assessed value to $1,000 (the “$15K reduction”).

How do Denver property taxes work?

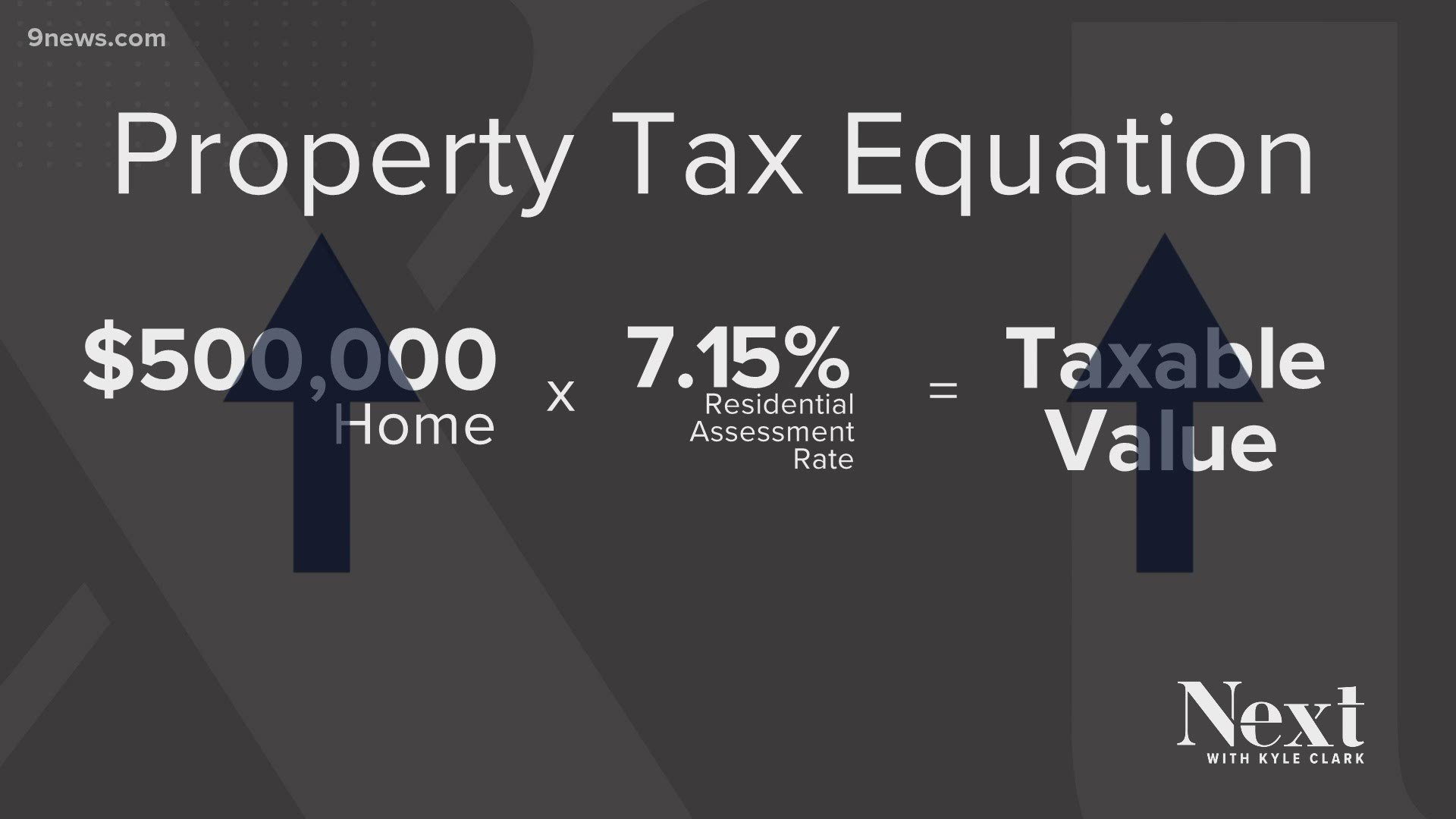

To calculate taxes, Actual Value is adjusted by the appropriate Assessment Rate to determine its Assessed Value. Commercial properties are multiplied by 29% (0.2900), single-unit residential properties are multiplied by 6.95% (0.0695) and apartments are multiplied by 6.80% (0.068).

Are Denver property taxes paid in arrears?

Since property taxes are paid in arrears, Land Title must collect any outstanding taxes from the prior year and prorate the current year taxes as outlined in paragraph 16.1. 1 of the contract. In order to pay outstanding taxes, we check two sources. The first includes online county records to verify the amount due.

How do I find my Denver property taxes?

Please call (720) 913-9300 to obtain the correct amount due. During the months of December and early January of each year, the Treasury Division staff is in the process of finalizing the Property Tax Roll Information. During these months, online viewing is only available for property taxes.

What is the new tax law in Colorado 2023?

Effective January 1, 2023, single filers are limited to $12,000 and joint filers are limited to $16,000 of deductions. The current standard deduction in Colorado is $12,950 for singles and $25,950 for joint filers. As such, all individuals with incomes over $300,000 will be subject to deduction limitations.

How do I pay property taxes in Colorado?

- Begin by accessing Revenue Online(opens in new window).

- Locate the “Payment Options” box on the Revenue Online(opens in new window) homepage.

- Click “Make a Payment.”

- Read the information about the various service fees and processing timelines before selecting a payment option.

The Denver Property Tax Relief Program is now open! Eligible applicants could receive an average refund of $1,000 from property taxes paid in 2022, or the equivalent in rent. Apply today or share with family and friends who might qualify! Learn more: https://t.co/IBiNZVo3i6

— Denver Human Services (@DenverDHS) May 2, 2023

How do I find my property tax records in Colorado?

You may use Denver's Assessment and Taxation System to search property assessment and tax data. You can obtain information about a property by entering an address, Parcel ID or schedule number.

Frequently Asked Questions

What happens if you don't pay your property taxes in Colorado?

If you do not pay the service lien, the lien will be sold at the tax lien auction and a tax lien will be placed on the property. If the lien is not redeemed within three (3) years from the date of sale, the tax buyer may apply for a deed.

How do I transfer a property title in Georgia?

- Names the Current Owner and New Owner.

- Contains a Description of the Property.

- Signed by Current Owner.

- Two Witnesses: Unofficial Witness & Notary Public.

- Complete a PT-61, Transfer Tax Form.

- Record Deed in County Real Estate Records.

How do I run a title search on a property in Georgia?

How to Perform Georgia Title Searches. Often, title searches are among the first things that have to be done when buying a property. The documents used to perform a title search are public, and you can obtain the records from any Georgia courthouse, county assessor office, or recorder's office.

How long do you have to transfer property after death in California?

40 days

You must wait at least 40 days after the person dies. What if I need help? Or, read the law on property transfers. See California Probate Code, §§ 13100-13115.

Do you have to disclose how someone died in a house in California?

A person's family often struggles with selling their house after a death. And they may wonder about Death in-house disclosure if their loved one passed away at home. Unless the death occurred within the past three years. Only California requires voluntary disclosure of natural causes.

What happens if you don't file probate in California?

If no one files probate for an individual who has died and owned assets in California, the court can freeze the decedent's assets, making them inaccessible to heirs and other beneficiaries until debts are paid.

Can a deed be recorded after death in California?

The California legislature introduced Transfer on Death Deeds in 2016, and they updated the law effective 2022. The law is not simple. Transfer on death needs must be notarized and recorded with the local county recorder. Just like a standard grant deed or quitclaim deed.

What is a quiet title petition in Georgia?

An action to quiet title is designed to remove clouds upon the title to land and to conclusively establish that the petitioner is the owner of all the interest in land, so that the land will be marketable. Georgia law provides two forms of quiet title actions: Conventional and Statutory.

How do I transfer ownership of a house in Georgia?

How much does a quiet title action cost in Georgia?

Get a FREE Consultation for your Tax Deed Property

The average cost for barment of a tax sale property in Georgia can be $1,000-$2,5000. This must be completed before you can even start a quiet title action, which will cost, on average, another $4,500+ and take 6-24 months to complete.

How much does a title search cost in Georgia?

How Much is a Title Search in Georgia?

| Type of Search | Cost |

|---|---|

| Two Owner Search (Residential) | $99.95 |

| 30-Year Search (Residential) | $150.00 |

| Title Update | $35.00 |

| Commercial O&E Report | $175.00 |

How do you tell if a place has bed bugs before moving in?

- Rusty or reddish stains on bed sheets or mattresses caused by bed bugs being crushed.

- Dark spots (about this size: •

- Eggs and eggshells, which are tiny (about 1mm) and pale yellow skins that nymphs shed as they grow larger.

- Live bed bugs.

What are 3 signs you might have bed bugs?

- Bed Bug Bites On Your Skin. Bed bugs need to eat, plain and simple.

- Blood Stains On Your Sheets.

- Finding Dark Specks On Your Sheets.

- Musty Smelly Around your Mattress.

- Finding A Bed Bug or Casing.

- Find the Bed Bug Harborage Sites.

- Launder All Fabrics on High Heat.

- Inspect and Remove Clutter.

How do I make sure my new apartment doesn't have bed bugs?

Look for the signs yourself

Here's what to look for and where: Molted skins – Immature bed bugs must shed their skin several times in order to grow larger, and they usually leave them along mattress seams, in ceiling junctions, along baseboards, and on clothes and household items.

How fast do bed bugs spread in apartments?

Way 1: How fast do bed bugs spread from room to room? Ultimately, it can take mere minutes to travel from room-to-room, with infestations growing in a matter of weeks or months. Every day, bed bugs can lay between one and 12 eggs, and anywhere from 200 to 500 eggs in a lifetime.

How long does it take for a bed bug infestation to get bad?

Over time, however, bed bugs multiply exponentially so within several weeks or months, you could have a very large infestation on your hands if you don't get it treated.

Are property taxes paid in advance in Colorado?

How are real estate taxes paid in Colorado?

Property tax bills, reflecting the taxes due for the preceding year, are mailed as soon after January 1 as possible. Tax amounts greater than $25 may be paid in one payment by April 30 or in two equal payments. The first half payment is due by the last day of February. The second half payment is due by June 15.

Who pays property taxes at closing in Colorado?

Prorated property taxes and HOA fees: Sellers are responsible for property taxes up to the closing date. And if the home is part of a homeowners association, they will be on the hook for HOA fees through the closing date as well.

FAQ

- What are property taxes in Colorado 2023?

2023 tax year: 6.765% of the actual property value, minus the lesser of $15,000 or the amount that reduces the assessed value to $1,000 (the “$15K reduction”).

- At what age do you stop paying property taxes in Colorado?

Least 65 years old

The property owner must be at least 65 years old and have owned and occupied the property as his or her primary residence for the 10 years immediately preceding the assessment date.

- Do you pay real estate taxes in Colorado?

- Tax rates in Colorado do not apply to market value, but rather to assessed value, which is equal to a fraction of the market value. That fraction, which is called the residential assessment rate, is recalculated regularly by the state. As of now, the state estimates it to be 7.15%.

- How long do you have to pay property taxes in Colorado?

Property tax statements are mailed once a year in January. Taxes can be paid in a lump-sum payment or in two installments: If paid as a lump-sum, payment in full is due by April 30. If paid in installments, the first half is due by the last day of February and the second half is due by June 15.

- How do you know if you are bed bug free?

You can either manually inspect the same areas each day, or some clients find it helpful to put a sticky adhesive trap around the bed legs which would pick up bed bugs that are on the move. If no bed bugs show up in the trap after several days, that's one indication that they have been completely eradicated.

- How do I know if my apartment has bed bugs before moving in?

Common signs and symptoms of a possible bed bug infestation: Small red to reddish brown fecal spots on mattresses, box springs, bed frames, mattresses, linens, upholstery, or walls. Molted bed bug skins, white, sticky eggs, or empty eggshells. Very heavily infested areas may have a characteristically sweet odor.

- How do I know if my new apartment has bugs?

- Take a good whiff. When you first step inside a home or apartment, let your nose tell you if something seems wrong.

- Scan the room. Do you see any pests?

- Keep a keen eye out for spots.

- Bring a flashlight for dark areas.

- Take a look at the baseboards.

- Ask about the landlord's pest control policy.

- How long does it take for bed bugs to infest an apartment?

Way 1: How fast do bed bugs spread from room to room? Ultimately, it can take mere minutes to travel from room-to-room, with infestations growing in a matter of weeks or months. Every day, bed bugs can lay between one and 12 eggs, and anywhere from 200 to 500 eggs in a lifetime.

- Does renters insurance cover bed bugs?

Is there renters insurance that covers bed bugs? Standard renters insurance policies typically won't offer coverage for bed bug infestations or any resulting damage. If an infestation occurs, you or your landlord are responsible for covering the extermination costs.

- Do bed bugs need to be reported?

If you think you have found bed bugs in a hotel, nursing home, hospital, prison, or on public transportation, you should report it to property staff and the local county health or environmental health department.

- What is the bed bug law in New York State?

These pests are considered a Class B violation, indicating they are harmful to human health. As such, landlords have 30 days to exterminate bed bugs. If a landlord refuses to take action, the tenant may call 311 to file a complaint with Housing Preservation and Development.

- Are landlords responsible for bedbugs in Texas?

Uncooperative Landlords

In Texas, your landlord needs to address the bed bug issue within seven days of you informing them about the infestation. If they don't, you can sue them and force them to address the infestation and cover your legal and rent expenses.

- Can bed bugs transfer between apartments?

- Bed bugs can travel from one apartment to another by wall voids, plumbing and electrical conduits, etc. They are also transported in luggage, briefcases, backpacks, purses and so on. Oftentimes apartment dwellers will rent furniture that, if not treated properly, will bring bed bugs with it.

- How do you transfer property after death in California?

California offers a type of deed known as a revocable transfer-on-death deed, which allows a title holder to list beneficiaries to whom the property should automatically transfer upon their death. If a valid transfer-on-death deed exists, it is unlikely the property in question would have to be probated.

- Does California allow transfer on death deeds for real estate?

In addition to the notary requirement, a transfer on death deed must be signed by two witnesses (similar to a will), and it must be recorded within 60 days of the notary date. Further, when the property owner dies, the beneficiary of the transfer on death deed must give legal notice to the property owner's heirs.

- What happens to a house when the owner dies in California?

In California, if a property owner dies without a valid will, the estate's property is distributed according to the state's intestate succession law. Priority is given to the surviving spouse, followed by children and grandchildren.

- Does transfer on death avoid probate in California?

Transfer-on-Death Registration for Vehicles

California allows transfer-on-death registration of vehicles. If you register your vehicle this way, the beneficiary you name will automatically inherit the vehicle after your death. No probate court proceeding will be necessary.

- Where do I file a death deed transfer in California?

You must record a TOD deed within 60 days of notarizing it or it becomes invalid. Record the TOD deed in the county where the property is located. The Recorder's Office charges a recording fee and additional fees as set by state law.

- How much does it cost to transfer a deed in GA?

$1.00 per thousand

The State of Georgia Transfer Tax is imposed at the rate of $1.00 per thousand (plus $0.10 / hundred) based upon the value of the property conveyed. Example: A property selling for $550,000.00 would incur a $550.00 State of Georgia Transfer Tax.

When are real estate taxxes due in denver col

| How do you transfer ownership of property from parent to child in Georgia? | If you decide that you want to share ownership with your children, you can simply record it on the deed. The state of Georgia does not have a transfer on death deed, but you can choose to title your home as a joint tenant with right of survivorship with your children. |

| How does an executor transfer property in Georgia? | The executor will be charged with the duty to cause an “Executor's Deed” or “Assent to Devise” to be drafted, executed and filed with the real estate records office where the real estate is located. The “Executor's Deed” or “Assent to Devise” formally transfer title from the deceased to the intended beneficiary. |

| Does Georgia have a Tod deed? | An owner who records a TOD deed retains the right to revoke the deed or sell or mortgage the property. Georgia is among the minority of states that do not recognize TOD deeds. A Georgia property owner may be able to achieve a similar objective using a living trust. |

| How do I transfer a house deed to a family member in Georgia? | Here are the steps to completing a deed transfer in Georgia:

|

| What are the requirements for a TOD deed in California? | Code §§ 5600 to 5696.) You must (1) sign the deed, (2) have two adults who are not beneficiaries witness your signing of the deed, (3) have your signature notarized, and (4) record (file) the deed with the county clerk's office within 60 days of having it notarized. Otherwise, the TOD deed won't be valid. |

| Does California allow TOD deeds? | The California legislature introduced Transfer on Death Deeds in 2016, and they updated the law effective 2022. The law is not simple. Transfer on death needs must be notarized and recorded with the local county recorder. Just like a standard grant deed or quitclaim deed. |

| What is an affidavit of death California? | Affidavit-death forms are used to change the title on real property after the death of a joint tenant, trustee or trustor. Information and forms are available from the Sacramento County Public Law Library. Blank forms may also be available at office supply stores. |

| What is a California affidavit death of Transferor TOD deed? | This form is an affidavit that may be used to clear title to real property for which the deceased transferor had recorded—and not revoked—a revocable Transfer on Death (TOD) Deed. This form includes practical guidance, drafting notes, and optional clauses. |

| Does a TOD avoid probate in California? | If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at your death. No probate court proceedings will be necessary; the beneficiary will deal directly with the brokerage company to transfer the account. |

| What happens to sole proprietorship when owner dies in California? | Typically, a sole proprietorship dies with the owner. However, the personal representative can use Probate Code section 9760 to take necessary steps to convert the business from a sole proprietorship to an alternative form. |

| What happens to sole proprietorship when owner dies? | If the business is a sole proprietorship, it ceases to operate upon the owner's death. Its assets and debts become part of the owner's holdings, and the estate is distributed according to the terms of the will. |

| Who is entitled to property after death in California? | If the person named in the will cannot act or there is no will, then there's an order of priority for who may be appointed a personal representative. The order of priority is any surviving spouse or domestic partner, then a child, then a grandchild, then a parent, and then a sibling. |

| Can a sole proprietorship be passed to the proprietor's heirs through a gift or an estate? | Sole Proprietorships An unincorporated sole proprietorship dissolves upon the death of the owner. The business's cash, inventory, and other assets are the owner's personal property and become part of the owner's estate just like their other personal effects. There is no separate business to pass on. |

| How do I transfer a house title after death in California? | To get title to the property after your death, the beneficiary must: Record a certified copy of the death certificate in the county clerk's office. File a Change in Ownership statement. Your beneficiary can obtain this form from the county assessor in the county where the real estate is located. |

| How do you transfer property after death from a trust in California? | When the trust owner dies, the trustee can transfer property out of the trust by using a quitclaim or grant deed transferring ownership of the property to the beneficiary. |

| What is revocable transfer on death deed California? | Long Term Care Justice and Advocacy. (800) 474-1116 (CONSUMERS ONLY) • (415) 974-5171 • WWW.CANHR.ORG. A law that became effective January 1, 2016, creates a Revocable Transfer on Death Deed (“TOD. Deed”) as a way for California residents to transfer residential property to named beneficiaries, effective. upon death. |

| What are the different ways to hold title in Georgia? | Georgia recognizes three basic types of ownership: sole ownership, joint tenants, and tenants in common. |

| What is ownership of real estate by one individual called? | Sole ownership or tenancy of severalty. By far the most simple, this occurs when a single person owns the property. A sole owner is free to sell, gift, or bequeath the property to anyone without needing permission of any kind. Tenancy by the entireties. |

| What are the two ways a person or other entity can take title to or own real estate? | The most common of these methods of title holding are joint tenancy, tenancy in common, tenants by entirety, sole ownership and community property. Joint Tenancy is when two or more people hold title to real estate jointly, with equal rights to enjoy the property during their lives. |

- What represents a legal title of ownership?

In United States law, evidence of title is typically established through title reports written up by title insurance companies, which show the history of title (property abstract and chain of title) as determined by the recorded public record deeds; the title report will also show applicable encumbrances such as

- What is the method of holding title?

to real property in California may be held by individuals, either in Sole Ownership or in Co-Ownership. Co-Ownership of real property occurs when title is held by two or more persons.

- Can bed bugs spread from apartment to apartment?

- Bed bugs can travel from one apartment to another by wall voids, plumbing and electrical conduits, etc. They are also transported in luggage, briefcases, backpacks, purses and so on.

- How quickly do bed bugs spread in apartment buildings?

Keep in mind that bed bugs are speedy travelers capable of covering distances of up to three feet per minute, so if they've infested your neighbor's apartment, it's only a matter of time before they spread to your unit as well.

- How hard is it to get rid of bed bugs from an apartment?

Bed bug treatment consists of a thorough inspection followed by vacuuming and treatment of all detected bug hiding spots. Treatment is labor intensive and may take several hours per apartment. It will also probably require several visits and treatments to permanently get rid of a bed bug problem.

- In ca how to transfer real estate property when you have a revocable transfer on death deed

Oct 1, 2022 — In California, certain assets can by-pass probate by using a transfer on death deed, here's everything you need to know about the TODD.

- Are landlords responsible for bed bugs in Texas?

Uncooperative Landlords

In Texas, your landlord needs to address the bed bug issue within seven days of you informing them about the infestation. If they don't, you can sue them and force them to address the infestation and cover your legal and rent expenses.

- How do real estate taxes work in Colorado?

Hear this out loudPauseColorado Property Tax Rates

Rates are expressed in mills, which are equal to $1 for every $1,000 of property value. A tax of 10 mills on a property with an assessed value of $10,000 is equal to $100 ($10,000 x 0.1). An effective tax rate is the amount you actually pay annually divided by the value of your property.

- Does Colorado have a personal property tax?

Hear this out loudPauseYes. Personal property valuation for ad valorem property tax purposes differs from valuation and accounting procedures allowable for income tax and financial reporting purposes. All personal property is taxable in Colorado unless it is specifically exempted by law.

- How often do you have to file sales tax in Colorado?

Hear this out loudPauseFiling Frequency & Due Dates

Filing frequency is determined by the amount of sales tax collected monthly. $15 or less per month: Sales tax returns may be filed annually. Annual returns are due January 20. Under $300 per month: Sales tax returns may be filed quarterly.

- How often are property taxes paid in Colorado?

Hear this out loudPauseProperty tax statements are mailed once a year in January. Taxes can be paid in a lump-sum payment or in two installments: If paid as a lump-sum, payment in full is due by April 30. If paid in installments, the first half is due by the last day of February and the second half is due by June 15.

- How do I file a TOD in California?

- Step 1: Locate the Current Deed for the Property.

- Step 2: Read the “Common Questions” Listed on Page 2 of the TOD Deed.

- Step 3: Fill Out the TOD Deed (Do Not Sign)

- Step 4: Sign in Front of a Notary; Have Two Witnesses Sign.

- Step 5: Record the Deed at the Recorder's Office within 60 Days of Signing It.

- What are the disadvantages of a TOD deed?

In some states, such as California, multiple beneficiaries on TOD deeds can't inherit unequal property shares, and you can't name a backup beneficiary. In addition, your estate plan may be too complex for a TOD deed if you have multiple children to whom you'd like to pass property.

- How do I transfer a property title to a family member in California?

- From here, the process looks like this:

- Choose the most appropriate deed.

- Prepare the deed.

- Complete the deed with accurate information about the property and the person being added.

- Sign the deed in the presence of a notary public.

- File the deed with the county recorder's office.

- Update the property records.

- From here, the process looks like this:

- Is transfer on death a good idea?

A transfer on death deed can be a useful addition to your estate plan, but it may not address other concerns, like minimizing estate tax or creditor protection, for which you need a trust. In addition to a will or trust, you can also transfer property by making someone else a joint owner, or using a life estate deed.

- Are landlords responsible for bed bugs in Indiana?

Failing to address any hazard, such as a bed bug infestation, could make hotels and motels liable for the harm that their guests suffer. In apartments, general law applies. That is, it is landlord responsibility to keep his or her rental apartment (or any rental property) in a habitable condition.

- What are the OSHA rules on bedbugs?

Under the OSHA general duty standard, an employer has an obligation to provide a safe work environment free of hazards that may cause physical harm. If it is determined that there are bed bugs in your workplace, you should take immediate action to eradicate the infestation (typically by calling an exterminator).

- Can a tenant withhold rent for repairs in Indiana?

Unlike some states, Indiana does not have a law that lets tenants withhold rent or make repairs and deduct it from the rent. Generally, if you do not pay rent, you could be evicted. There may be very limited cases where you can repair and deduct, but you should talk to a lawyer first.