Capital Gains Taxes on Property

Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. You can also add sales expenses like real estate agent fees to your basis. Subtract that from the sale price and you get the capital gains.

What is the 2023 capital gains tax rate?

For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300. Above that income level the rate climbs to 20 percent.

What is the capital gains tax on $200 000?

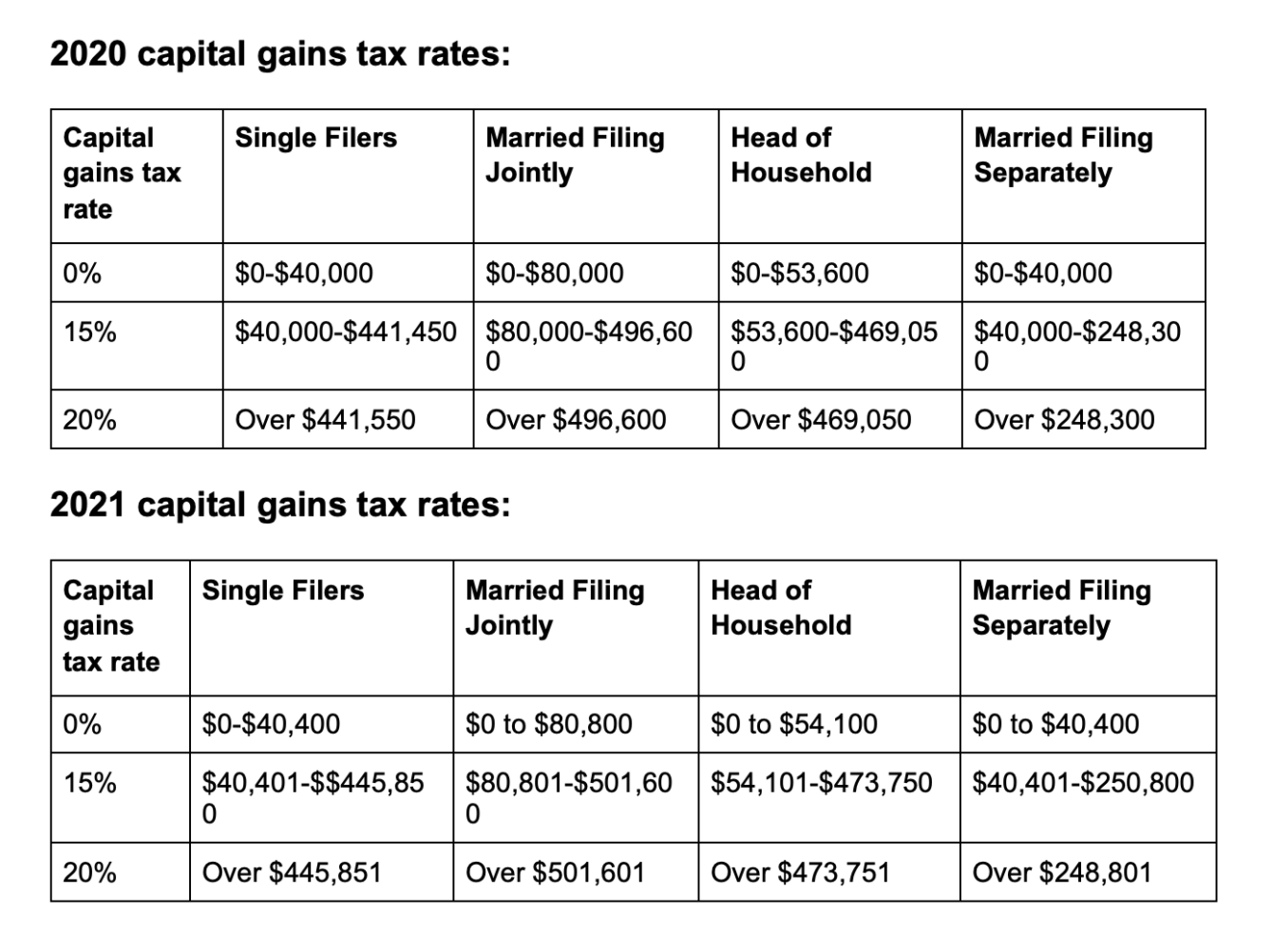

Capital gains tax rate – 2021 thresholds

| Rates | Single | Married Filing Separately |

|---|---|---|

| 0% | Up to $40,400 | Up to $40,400 |

| 15% | $40,401 to $445,850 | $40,401 to $250,800 |

| 20% | Above $445,850 | Above $250,800 |

What is the IRS capital gains tax rate on real estate?

The capital gain will generally be taxed at 0%, 15%, or 20%, plus the 3.8% surtax for people with higher incomes. However, a special rule applies to gain on the sale of rental property for which you took depreciation deductions.

How to avoid paying capital gains tax on sale of primary residence?

Home sales can be tax free as long as the condition of the sale meets certain criteria: The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify.

What is federal capital gains tax rate on real estate?

The gain or loss is the difference between the amount realized on the sale and your tax basis in the property. The capital gain will generally be taxed at 0%, 15%, or 20%, plus the 3.8% surtax for people with higher incomes.

NEW: Biden budget proposes 25% tax on billionaires + nearly doubling capital gains rate to 39.6%

— Justin Sink (@justinsink) March 9, 2023

Income tax over $400k would rise to 39.6%, corp tax up to 28%

also closes crypto, oil, real estate tax breaks for $3t deficit reduction

w @laurapdavison https://t.co/QX6OQfPssE

What is the federal capital gains tax rate for 2023?

Long-Term Capital Gains Tax Rates for 2023

Aug 16, 2023

| Rate | Single | Head of Household |

|---|---|---|

| 0% | $0 – $44,625 | $0 – $59,750 |

| 15% | $44,626 – $492,300 | $59,751 – $523,050 |

| 20% | $492,300+ | $523,050+ |

Frequently Asked Questions

How is capital gains tax calculated on real estate?

Capital Gains Taxes on Property

Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. You can also add sales expenses like real estate agent fees to your basis. Subtract that from the sale price and you get the capital gains.

How much can you earn and still pay 0% capital gains taxes in 2023?

$44,625

For 2023, you may qualify for the 0% long-term capital gains rate with taxable income of $44,625 or less for single filers and $89,250 or less for married couples filing jointly.

Does income bracket affect capital gains tax?

The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% or 37%.

How can you avoid paying capital gains tax on real estate profits?

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

FAQ

- What is the $250000 / $500,000 home sale exclusion?

- There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

- What is the one time capital gains exemption?

- You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married and filing jointly. The exemption is only available once every two years.

- How do I avoid capital gains tax on my house?

- A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

- How do I calculate my capital gains tax?

- How to Calculate Long-Term Capital Gains Tax

- Determine your basis. The basis is generally the purchase price plus any commissions or fees you paid.

- Determine your realized amount.

- Subtract the basis (what you paid) from the realized amount (what you sold it for) to determine the difference.

- Determine your tax.

What is the rate for capital gains tax on real estate

| What is my capital gains rate if I have no income? | For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300. Above that income level the rate climbs to 20 percent. | ||||||||||

| What is the 0% tax bracket for capital gains? | Capital gains tax rates for 2023

|

||||||||||

| Can you avoid capital gains tax if your income is low? | Capital Gain Tax Rates Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $41,675 for single and married filing separately, $83,350 for married filing jointly or qualifying surviving spouse or $55,800 for head of household. | ||||||||||

| Is there a way to avoid capital gains tax on the selling of a house? | The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion. If the capital gains do not exceed the exclusion threshold ($250,000 for single people and $500,000 for married people filing jointly), the seller does not owe taxes on the sale of their house.9. |

- Is capital gains tax based on income level?

- Long-term capital gains tax rates for the 2023 tax year For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300. Above that income level the rate climbs to 20 percent.

- How much is IRS capital gains tax on real estate?

- If you sell a house or property in one year or less after owning it, the short-term capital gains is taxed as ordinary income, which could be as high as 37 percent. Long-term capital gains for properties you owned for over a year are taxed at 0 percent, 15 percent or 20 percent depending on your income tax bracket.

- How much income tax do you pay on capital gains?

- The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% or 37%.

- Is capital gains added to your total income and puts you in higher tax bracket?

- Long-term capital gains cannot push you into a higher income tax bracket. Only short-term capital gains can accomplish that, because those gains are taxed as ordinary income. So any short-term capital gains are added to your income for the year.