In general, a landlord will look for a credit score that is at least “good,” which is generally in the range of 670 to 739.

Can I rent with a 600 credit score?

Wealthier, more competitive areas will require a higher minimum score, as will new or luxury buildings. However, a good rule of thumb is that most landlords look for a credit score of at least 600. Anything under 600 is considered bad credit, but don't worry – there are many ways to get around bad credit.

Is 500 a good credit score to rent an apartment?

Is 500 a Good Credit Score for Renting an Apartment? Unfortunately, 500 is considered a poor credit score and may cause difficulties for you when you start renting.

Is 650 a good credit score for renting an apartment?

The Fair Isaac Corporation, or FICO, specializes in “predictive analytics.” Even though it's not the only credit-scoring company available, it carries the most weight when you apply for credit. FICO suggests that a credit score of 650 and above is generally more than enough to rent an apartment.

Which FICO score do landlords use?

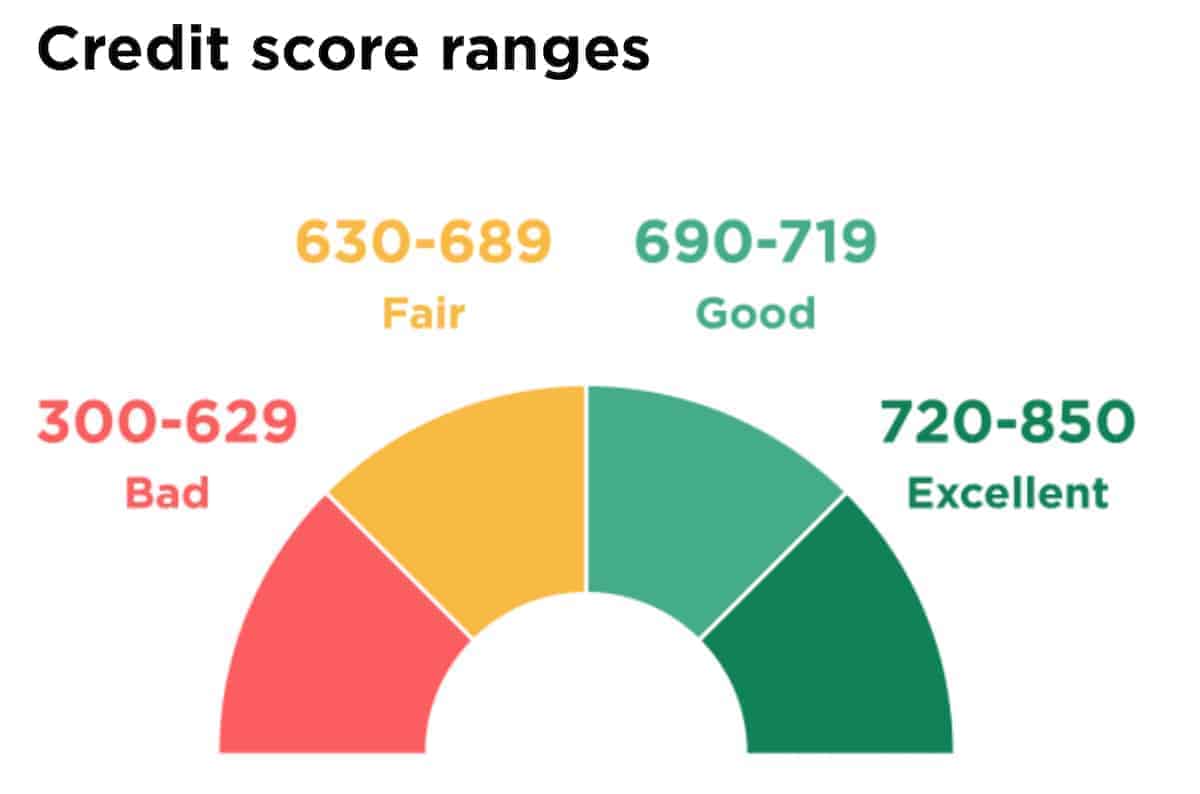

Most landlords use FICO credit scores to determine if an applicant qualifies for an apartment. The typical categories for those scores are: Exceptional: 800 to 850. Very Good: 740 to 799.

What is a decent credit score to rent an apartment?

It's simply a business decision. Most individuals or companies renting an apartment want credit scores from applicants to be 620 or higher. People with credit scores lower than 620 may indicate a high risk of default on rent owed.

A credit score is a number that estimates how likely you are to repay money and pay bills.

— Andrew Lokenauth | TheFinanceNewsletter.com (@FluentInFinance) May 17, 2023

A good credit score leads to lower interest rates, which results in savings.

A bad credit score leads to higher interest rates and difficulty getting approved for loans, which is costly.

What credit score will get you denied for an apartment?

The minimum credit score needed to rent an apartment varies from location to location. Wealthier, more competitive areas will require a higher minimum score, as will new or luxury buildings. However, a good rule of thumb is that most landlords look for a credit score of at least 600.

Frequently Asked Questions

What is a good resident score?

The credit score is supplied by TransUnion and is also known as a “Resident Score”. This score ranges from 300 - 850. You should have minimum criteria that all tenants must fit. For example, a score of above 700 is excellent, a score of 650 or more is good, and a score of under 600 might be cause for concern.

What credit score is needed for an apartment?

You'll want to shoot for having a good credit score — generally in the range of 570-739 — to get an apartment. While you may be able to still get an apartment if you don't have solid credit, it will make it more challenging with the competition you're likely to face.

What type of credit score is needed to rent?

620

Generally, most landlords require applicants to have a credit score of at least 620 to be considered for rental housing. This means that if your FICO score is lower than 620, you may be denied an application or asked for additional security deposits or co-signers before being approved.

Is 680 a good credit score to rent an apartment?

The same research also found that building type affected credit score averages. High-end buildings saw an average score of 669, while low-end units had an average of 597. Anecdotally, many renters report that a score of 650 or above is often requested for approval of a rental application.

FAQ

- How much should I save each paycheck for an apartment?

- A popular standard for budgeting rent is to follow the 30% rule, where you spend a maximum of 30% of your monthly income before taxes (your gross income) on your rent. This has been a rule of thumb since 1981, when the government found that people who spent over 30% of their income on housing were "cost-burdened."

- Is 5000 enough to move out?

- If you have $5,000 set aside to move out, you don't necessarily have to worry about moving on a tight budget. Regardless, you should still make sure you are spending your money wisely. Keep reading for more information on how much it costs to move and how you can save money while moving!

- Is $2000 a month enough for an apartment?

- How much do you need to earn to afford $2,000 rent each month? Say you stick to the 30% rule or 40x the monthly rent, you would need to earn at least $80,000 annually to afford $2,000 per month in rent. “Typically, 30% of gross income is considered to be the boundary of affordability.

What is the credit score range to rent an apartment

| Can you live on $1000 a month after rent? | Bottom Line. Living on $1,000 per month is a challenge. From the high costs of housing, transportation and food, plus trying to keep your bills to a minimum, it would be difficult for anyone living alone to make this work. But with some creativity, roommates and strategy, you might be able to pull it off. |

| How much money should you have to rent an apartment | Jan 17, 2023 — How much money is needed to rent an apartment is a critical question. It is advisable to save an amount equal to at least 3-4 months' rent. |

| What does credit score need to be to rent an apartment? | In general, a landlord will look for a credit score that is at least “good,” which is generally in the range of 670 to 739. However, that can vary by landlord |

- How much savings should I have to rent?

- Look at your cash flow and liquidity, he suggests, to calculate whether you have enough saved to cover three to six months' worth of rent and debt obligations if you were to lose your income. The math may be trickier, but you'll have a much clearer sense of how much rent you can comfortably afford.

- Is $1,000 a month too much for rent?

- Your rent payment, including renters insurance (more on that later), should be no more than 25% of your take-home pay. That means if you're bringing home $4,000 a month, your monthly rent should cost you $1,000 or less. And remember, that's 25% of your take-home pay—meaning what you bring in after taxes.

- Is $10,000 enough to move out?

- Generally, you want to spend less than 1/3 of your monthly income on housing costs. Saving at least $5,000 to $10,000 before moving out is the gold standard.