Minnesota Housing Market Overview

On average, the number of homes sold was down 14.7% year over year and there were 6,156 homes sold in September this year, down 7,213 homes sold in September last year.

Is Minnesota expensive to buy a house?

What's the average house cost in Minnesota? The median sales price for homes in Minnesota is $349,650 as of the data provided for August 2023.

Is now a good time to sell a house in Minnesota?

Is Now a Good Time to Sell a House in Minnesota? Late spring and up to July are considered the home-selling months. You can sell faster and earn higher sale proceeds during this time of the year. As per 2022 data, the median sale price of houses sold in June 2022, was $350,200.

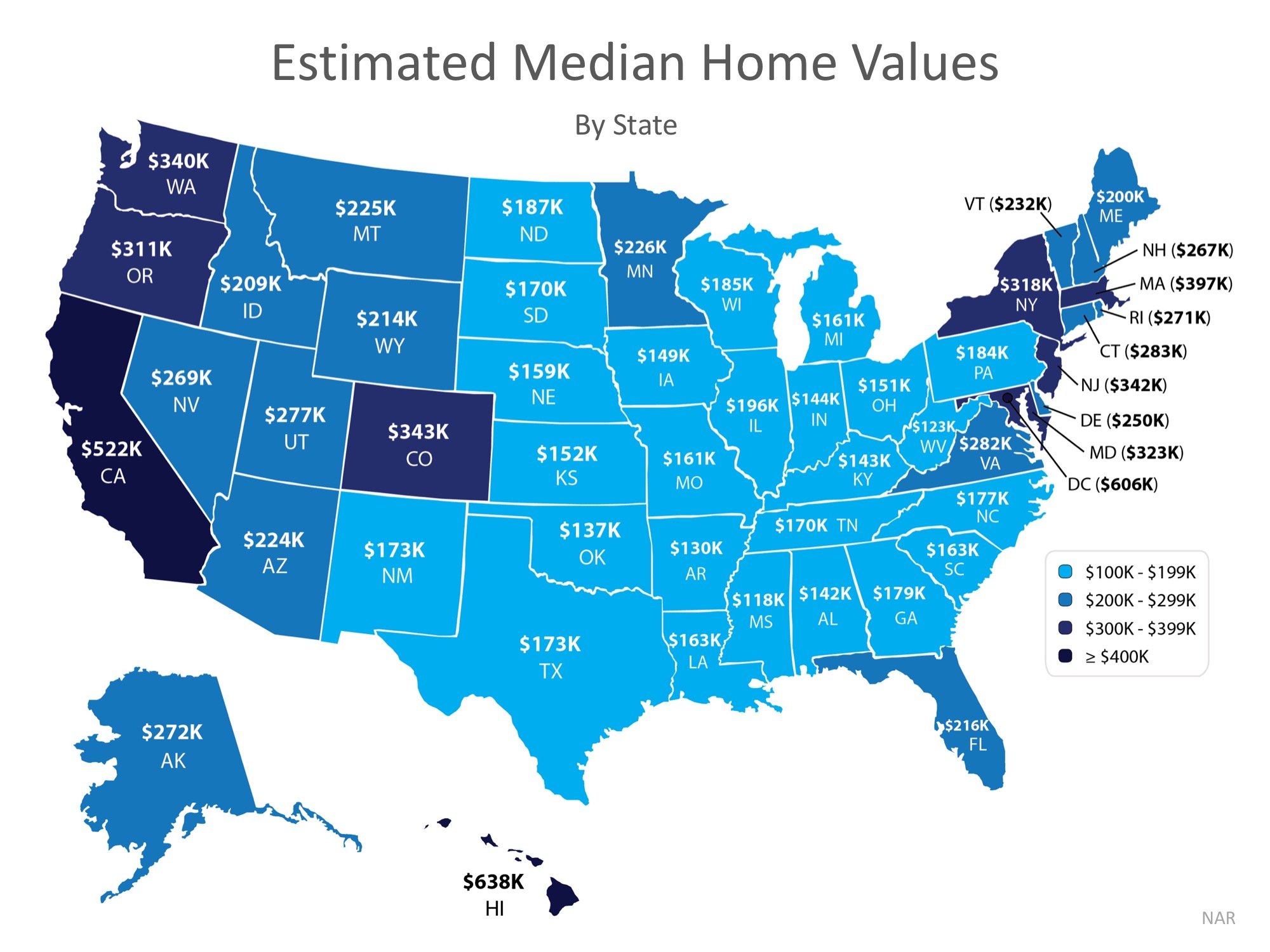

What is the average property rate in USA?

The average United States home value is $348,539, up 1.1% over the past year and goes to pending in around 13 days.

Is it a buyers or sellers market in Minnesota?

Seller's market

On top of that, the state is a seller's market, with supply far too low to meet demand. According to Minnesota Realtors, there was a 2.3-month supply of housing inventory available in July, well below the 5-to-6-month supply required for a balanced market.

How are real estate taxes calculated in Michigan?

The property tax rate in Michigan is referred to as a millage, and it's figured in mills. One mill is equal to 1/1,000 of a dollar. Or, more simply, for every $1,000 in taxable value, a property owner will pay $1 in property tax. Millage Rates (PDF) for the current year are available for review online.

This site lists Scott Graham's company as Uptown Realty & Management. If Scott's company is active in managing rental properties, that would be a pretty serious conflict of interest in him working on rent stabilization ordinances.https://t.co/rvOV1LJifv

— they/them (@jasoncomix) February 21, 2023

Who has the highest property taxes in Michigan?

Despite Detroit's status, Wayne County is not the Michigan county with the highest property taxes. The highest property taxes belong to Washtenaw County, where residents pay roughly $1,400 more in property taxes per year than Wayne County residents.

Frequently Asked Questions

Do senior citizens have to pay property taxes in Michigan?

How much does it cost to transfer a house deed in Michigan?

Do you have to file a property transfer affidavit in Michigan?

Who pays sales tax on house in Michigan?

The seller

Property transfer tax is an assessment charged by both the State of Michigan and the individual county. When you transfer real estate, they charge a fee as a percentage of the sales price. The seller is responsible for this fee unless it is otherwise agreed to be paid by the buyer.

What is the exclusion for the sale of a home in Michigan?

Home Sale. If you owned and lived in your home for two of the last five years before the sale, then up to $250,000 of profit may be exempt from federal income taxes. If you are married and file a joint return, then it doubles to $500,000.

How do I avoid capital gains in Michigan?

4 Tax Planning Ideas To Reduce Michigan Capital Gains Taxes

Sell appreciated assets in a tax-exempt trust: You can minimize your taxable capital gains by moving appreciated assets into a tax-exempt trust – a Charitable Remainder Trust, for example – before you sell.Who pays the tax buyers or sellers?

FAQ

- How much taxes do you pay when you sell a house in Michigan?

Sellers are typically responsible for covering the real estate transfer tax in Michigan, which includes a state tax of $3.75 for every $500 of value and an additional county tax of $0.55 for every $500 of value. (It can be higher in some counties.) Additionally, sellers here usually pay for the title insurance policy.

- What is the tax rate for sale in Michigan?

6%

City/Local/County Sales Tax - Michigan has no city, local, or county sales tax. The state sales tax rate is 6%. Retailers - Retailers make sales to the final consumer. Sales tax of 6% on their retail sales must be remitted to the State of Michigan.

- What is the $250000 / $500,000 home sale exclusion?

- There is an exclusion on capital gains up to $250,000, or $500,000 for married taxpayers, on the gain from the sale of your main home. That exclusion is available to all qualifying taxpayers—no matter your age—who have owned and lived in their home for two of the five years before the sale.

- Do I pay capital gains when I sell my house in Michigan?

Will You Have to Pay Taxes When You Sell Your Home in Michigan? If you're a typical home seller in Michigan, you do not need to report your capital gain to the IRS after the sale.

- Is there sales tax on a home purchase in Michigan?

The state transfer tax rate in Michigan is $3.75 for every $500 of property value, or 0.75% of the transferred property's value. In addition to the state tax, each individual county levies an additional transfer tax of $0.55 per $500.

- Do sellers pay closing costs in Michigan?

- Yes, sellers pay closing costs in Michigan (and every state). Sellers are on the hook for a number of expenses, including real estate commissions, one of the heftiest costs associated with any real estate transaction.

- Does buyer or seller pay transfer tax in Michigan?

Property transfer tax is an assessment charged by both the State of Michigan and the individual county. When you transfer real estate, they charge a fee as a percentage of the sales price. The seller is responsible for this fee unless it is otherwise agreed to be paid by the buyer.

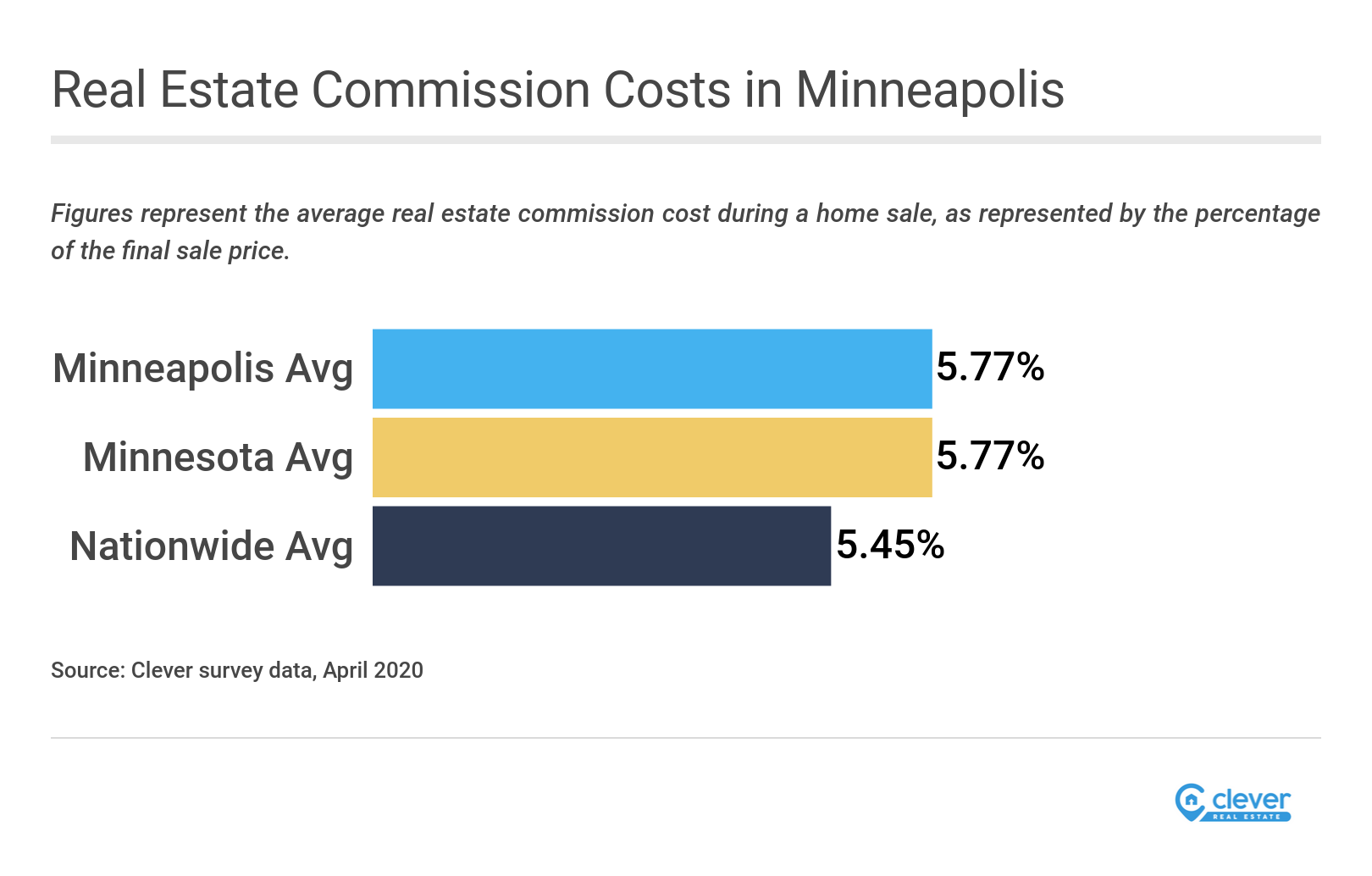

What is the average real estate rate in minnesots

| How do I transfer ownership of a house in Michigan? | A Michigan property owner transfers title to real estate by signing and recording a deed. A deed allows the current owner (grantor) to transfer real estate to a new owner (grantee). Depending on the situation, there may be multiple grantors or multiple grantees within a single deed. |

| Who files the property transfer affidavit in Michigan? | The new owner Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL. |

| Does Michigan have a transfer tax on real estate? | MICHIGAN REAL ESTATE TRANSFER TAX If the value of the real estate transferred is $100.00 or more, payment of State and County transfer tax is required. Rate of County tax = . 55c for each $500 or fraction thereof. Rate of State tax = 3.75 for each $500 or fraction thereof. |

| How to transfer property from one person to another in Michigan? | One of the most common types of deeds people are familiar with in Michigan are quitclaim deeds. These are used to quickly transfer property and are done using forms filed with the county. The document gives the person signing for the property the same interests in the real estate currently held by the existing owner. |

| What is the Michigan real estate exemption? | Property Tax Exemption An eligible person must own and occupy his/her home as a principal residence (homestead) and meet poverty income standards. The local Board of Review may interview the applicant in order to determine eligibility, according to the local guidelines, and will review all applications. |

| What is Michigan State transfer tax real estate? | MCL 207.505/MCL 207.526 $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed. |

| Who pays state transfer tax in Michigan? | The seller MICHIGAN REAL ESTATE TRANSFER TAX The tax shall be upon the person who is the seller or the grantor. In the case of an exchange of two properties the deeds transferring title to each are subject to tax, and in each case shall be computed on the basis of the actual value of the property conveyed. |

- What is a Michigan tax exemption?

Michigan provides an exemption from sales or use tax on tangible personal property used in tilling, planting, caring for or harvesting things of the soil, in the breeding, raising or caring of livestock poultry or horticultural products for further growth.

- What is the estate tax exemption for 2023 in Michigan?

Even though there is no Michigan estate tax, you might still owe the federal estate tax. The exemption for that tax is $12.06 million in 2022 and $12.92 million in 2023.

- Which of the following is most acceptable as evidence or proof of ownership of an estate in land?

The three major evidences of title are: (1) an abstract and opinion, (2) title insurance, and (3) a Torrens certificate of title. All states provide for the public recording of every document by which any estate or interest in land is created, transferred or encumbered.

- What are three methods commonly used to evidence marketable title and proof of ownership of real property in Texas?

- A warranty deed, a real estate lien note, and a deed of trust are the three principal legal documents in most Texas residential real estate transactions.

- What are the requirements for recording a deed in Michigan?

- RECORDING REQUIREMENTS

- Documents must have all original signatures and the names must be printed, stamped, or typed beneath the signatures.

- Documents executed in Michigan which convey or encumber real estate require a notary's acknowledgment.

- RECORDING REQUIREMENTS

- How do I transfer a property title in Michigan?

- Sign and date the quitclaim deed in a notary's presence, then file it with the County Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.

- What is the evidence of title?

- an official document proving someone owns something such as a piece of land, building, etc.: Ownership can be revoked, in the event of another party subsequently providing evidence of title. (Definition of evidence of title from the Cambridge Business English Dictionary © Cambridge University Press)