These may include your funeral expenses, debts you owe at your death, and expenses required to administer your estate.

What is the most property tax you can deduct?

$10,000 per year

If you itemize your deductions, you can deduct the property taxes you pay on your main residence and any other real estate you own. The total amount of deductible state and local income taxes, including property taxes, is limited to $10,000 per year.

Can you write off appliances for rental property?

Additionally, any capital improvements (this is work on the property that adds to or increases the property's value and is generally a permanent fixture), or costs, such as replacing appliances, cannot be deducted as rental property expenses but must be added to the cost basis of the property and depreciated.

Can you write off home improvements?

While capital improvement projects generally don't qualify for tax deductions, they might have other tax implications. That's because you can usually add capital improvement expenses to the home's cost basis—which might reduce your capital gains taxes when you sell the house.

What are examples of estate expenses?

Some of the most important expenses paid by the estate include:

- Outstanding debts, such as credit cards, medical bills or liens.

- Repairs or maintenance costs for estate property.

- Appraisals that are necessary to determine the value of estate assets.

- Closing costs associated with the sale of a home.

What expenses can be deducted on an estate tax return?

These deductible expenses include accounting fees to prepare your final income tax return, income tax returns for your estate or trust, and your estate tax return, if necessary. They also include attorney fees, executor fees, trustee fees, and probate costs necessary to administer your property and affairs.

3. More Expenses can be deducted.

— Aditya Todmal (@AdityaTodmal) November 6, 2022

All expenses can be deducted from a company account.

Companies:

1. First make a profit.

2. then deduct the expenses

3. & Pay tax on the remaining income

Individuals:

1. First Profit

2. Then Pay tax

3. Expenses with whatever is left.

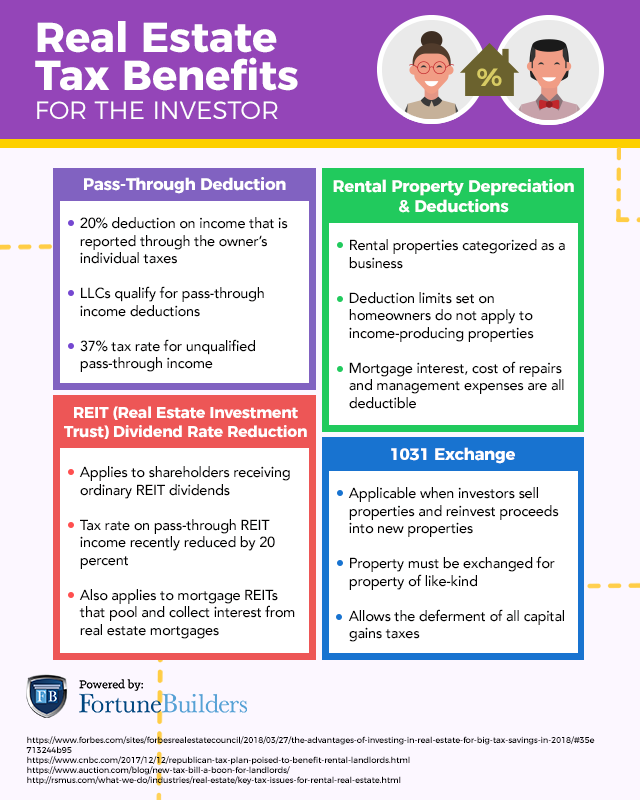

How can real estate reduce taxable income?

Tax Benefits Of Real Estate Investing: Top 6 Breaks And Deductions

- Use Real Estate Tax Write-Offs.

- Depreciate Costs Over Time.

- Use A Pass-Through Deduction.

- Take Advantage Of Capital Gains.

- Defer Taxes With Incentive Programs.

- Be Self-Employed Without The FICA Tax.

Frequently Asked Questions

Are real estate taxes itemized deductions?

If you itemize your deductions, you can deduct the property taxes you pay on your main residence and any other real estate you own. The total amount of deductible state and local income taxes, including property taxes, is limited to $10,000 per year.

What is a deduction in real estate?

Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare.

Can I write off home improvements?

When you make a home improvement, such as installing central air conditioning or replacing the roof, you can't deduct the cost in the year you spend the money. But, if you keep track of those expenses, they may help you reduce your taxes in the year you sell your house.

Can I write off my house payment on my taxes?

Only the interest you pay on your primary residence or second home can be deducted if the loans were used to purchase, build or improve your property, or used for a business-related investment. If the interest doesn't meet those requirements, then it doesn't qualify.

Do I need a license to rent my house in Philadelphia?

Renting out a property is a business. Therefore, you must also have the licenses and registrations necessary to operate a business. To rent out a single unit that: You occupy, you'll need an Activity License Number.

FAQ

- Do I need a license to rent my house in Florida?

- As a real estate broker or agent. To be able to rent someone else's house but to rent your own. House. No you do not need to be licensed. This is why by the way that for sale by owner.

- What a landlord Cannot do in Pennsylvania?

- Under the right to a safe and habitable home, a landlord cannot force a tenant to move into a home or unit “as-is” and cannot demand that the tenant be responsible for repairs. To be safe, and habitable, a unit or home should have: Working smoke alarms. Working hot water.

- Do I need a license to rent my house in Georgia?

- There is no Georgia landlord-tenant law stating local landlords need rental licenses. However, you may need a license in some cities or counties. Check with your local authorities to learn the rules in your part of the state.

- How to rent out your house in Texas?

- How to Become a Landlord in Texas Step-by-Step

- Check Local Requirements for Landlord License. In the state of Texas, getting a landlord license is not required.

- Find the Right Property.

- Prepare Your Property.

- Advertise Your Property.

- Screen Potential Tenants.

- Sign the Lease Agreement.

- What does rent out mean?

- grant the services of or the temporary use of, for a fee. “We rent out our apartment to tourists every year” synonyms: farm out, hire out. type of: lend, loan.

What expenses for real estate can be deducted taxes

| What do you mean by sub letting of house? | to allow someone to rent all or part of a house or other building that you are renting from someone else: Our rental contract states that we are not allowed to sublet the house. |

| Can I rent my primary home in Florida? | You can rent your home after January 1 of any year and still keep the homestead for that year, as long as the property is not rented for more than 30 days per calendar year for two consecutive years. See section 196.061(1), Florida Statutes. |

| How do you write off real estate investment expenses? | To claim any deductions on your rental property, you must fill out a Schedule E form when filing taxes. Along with that, you must show proof of each transaction claimed. That said, it can get complicated while filing your own taxes, so it may help to get professional tax advice. |

| Can realtors write off haircuts? | Real estate agents are eligible for a wide variety of tax deductions. Expenses such as client entertainment, personal wardrobe, and haircuts aren't deductible. |

| Can you write off estate expenses? | You can deduct the expenses incurred by an estate for its administration either as an expense against the estate tax or against the annual income tax of the estate. You may deduct the expense from the estate's gross income in figuring the estate's income tax on Form 1041, U.S. Income Tax Return for Estates and Trusts. |

- What can you deduct for home expenses?

- 8 Tax Breaks For Homeowners

- Mortgage Interest. If you have a mortgage on your home, you can take advantage of the mortgage interest deduction.

- Home Equity Loan Interest.

- Discount Points.

- Property Taxes.

- Necessary Home Improvements.

- Home Office Expenses.

- Mortgage Insurance.

- Capital Gains.

- 8 Tax Breaks For Homeowners

- Is owning a house a good tax write off?

- Tax benefits of owning a home Good news: the IRS offers several tax breaks for homeowners, from deductions for the interest on your mortgage to credits if you improve your home's energy efficiency in certain ways. The key is that you need to qualify — and be able to prove it.

- How many miles do realtors write off?

- Although it greatly depends on the average miles driven per year, the annual business mileage for a realtor is around 7,000 – 10,000 miles a year. This means a tax deduction of several $1,000s on average.

- Can I claim home insurance on my taxes?

- Homeowners insurance premiums are generally not deductible on your personal income tax return. However, there may be cases where you can deduct homeowners insurance premiums as a business expense. Consult a tax professional for more details about your specific situation.