Hey there, fellow house hunters and curious minds! Today, we're going to delve into the intriguing world of real estate agents and their commission when they successfully sell a house on behalf of a blogger. Trust us, it's going to be as fun and unobtrusive as a secret door leading to a hidden treasure!

So, you might be wondering, "How much does a real-estate agent get when they sell a house?" Well, buckle up, because we're about to embark on this exciting adventure!

In the good old United States of America, real estate agents are typically paid a commission based on a percentage of the final sale price of a home. The average commission percentage tends to hover around 5-6% of the home's sale price. Keep in mind, though, this can vary depending on factors like location, market conditions, and even the specific agreement between the agent and the blogger.

Now, let's break it down a bit further. Imagine our intrepid blogger, let's call them Blogging Bob, is selling their cozy little house for $300,000. If Bob's real estate agent charges a commission of 5%, they would receive $15,000 for their hard work and expertise in sealing the deal. That's not too

How does the IRS classify real estate agents?

How many miles do realtors write off?

Are leads tax deductible?

What is classified as a tax write off?

What is the IRS rule for real estate professional?

The Houston Chronicle says the Lt. Gov. Patrick/Senate plan more directly benefits homeowners, while the Gov. Abbott/House plan favors businesses and homes with higher incomes.

— Office of the Lieutenant Governor Dan Patrick (@LtGovTX) June 2, 2023

The article states 44% of all benefits go to the 1/5 of Texas households with the highest incomes.

So… https://t.co/4oBlEmhlyZ

What percentage of sales do most realtors make?

Frequently Asked Questions

How much does average realtor make in Ohio?

How much can you expect to make from real estate?

Does the buyer pay the realtor in Georgia?

FAQ

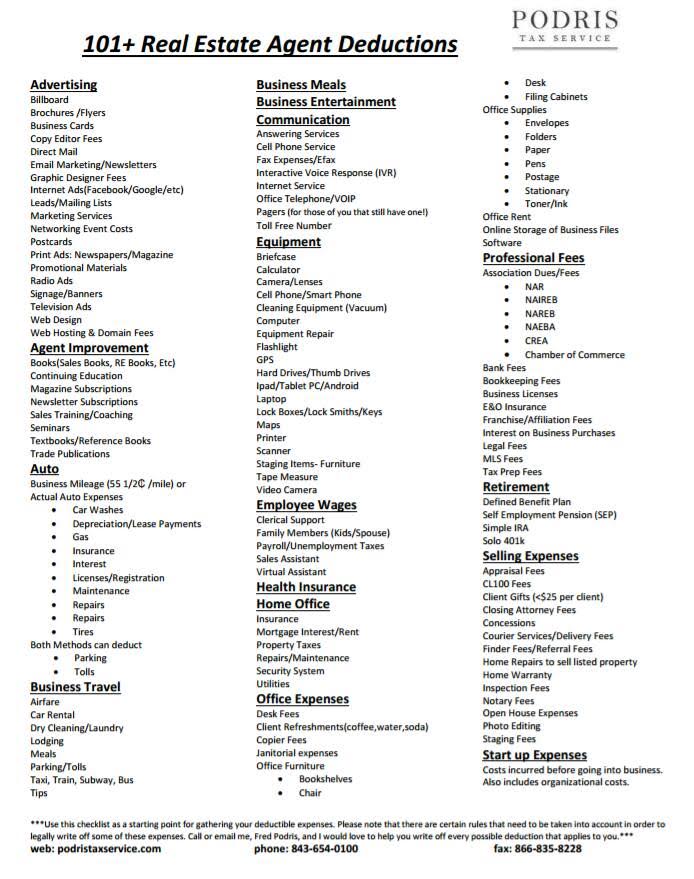

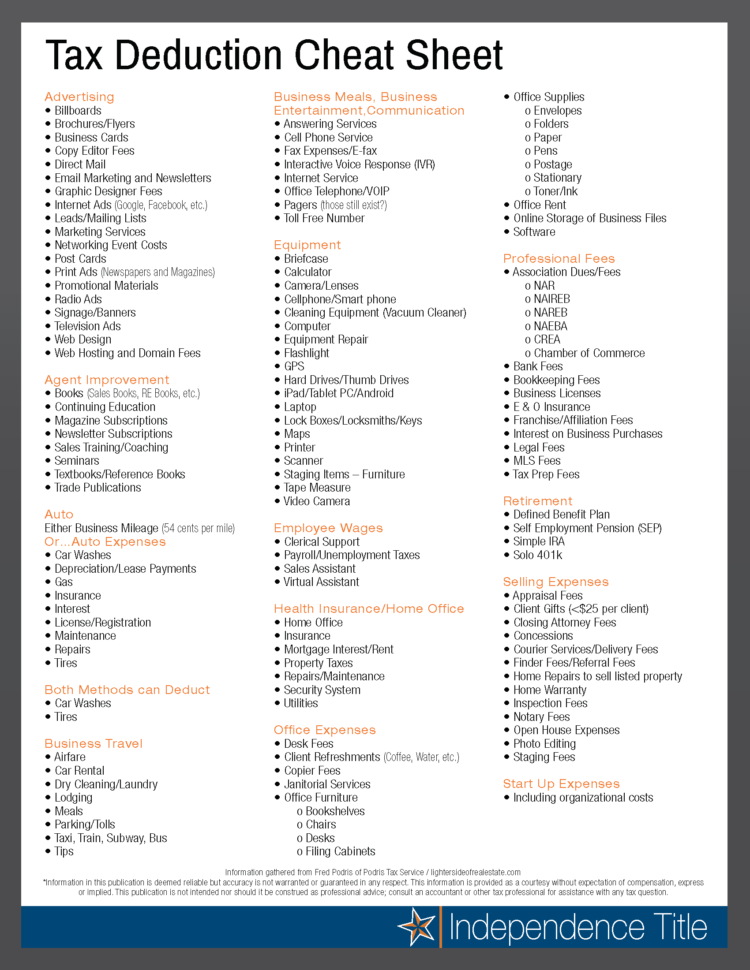

- Can realtors write off marketing expenses?

- Property marketing Expenses related to advertising like marketing materials, signs, photography, and staging are all deductible through the advertising expense deduction. The broad requirements of this deduction make it an especially valuable tax deduction for realtors.

- What is the average mileage deduction for a realtor?

- Although it greatly depends on the average miles driven per year, the annual business mileage for a realtor is around 7,000 – 10,000 miles a year. This means a tax deduction of several $1,000s on average.

- Are closing gifts tax deductible?

- According to IRS.Gov: If you give business gifts in the course of your trade or business, you can deduct all or part of the costs subject to the following limitations: You deduct no more than $25 of the cost of business gifts you give directly or indirectly to each person during your tax year.

What are the tax write offs categories for real estate agents

| Can I write off commissions? | Commissions paid by your business to employees, real estate agents and contractors, to name a few, are generally fully deductible business expenses that no entrepreneur should overlook. Depending on your business, commissions can quickly add up and end up being one of your largest deductions. |

| Is 6% normal for realtor? | Traditionally, real estate agents charge 5 percent to 6 percent of the final sale price, with the seller paying the entire commission. And traditionally, the residential real estate industry has been fine with the fiction that the services of the buyer's agent are "free" to the buyer. |

- How much does the average realtor make in Maryland?

- How much does a Real Estate Agent make in Maryland? As of Oct 24, 2023, the average annual pay for a Real Estate Agent in Maryland is $91,525 a year. Just in case you need a simple salary calculator, that works out to be approximately $44.00 an hour. This is the equivalent of $1,760/week or $7,627/month.

- How much does a real estate person get from the sale of a house

- Jun 29, 2021 — A 6% commission on a home selling at $287,000 would equal $17,220. Even after a 50/50 commission split, an agent could earn $8,610 on the home