A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

How is capital gains calculated on sale of property?

Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain. If you sold your assets for less than you paid, you have a capital loss.

How does capital gains tax work on a house?

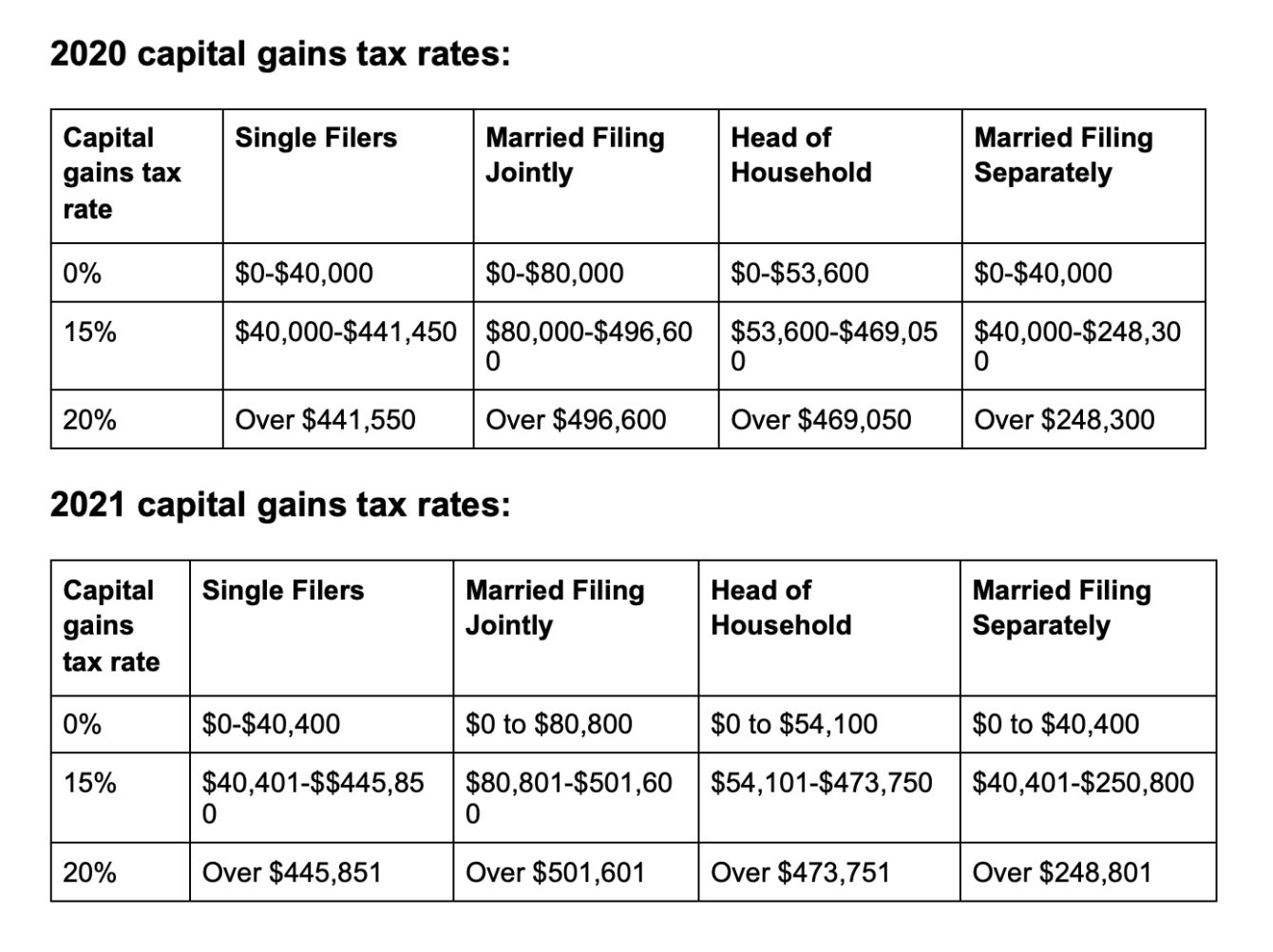

The rate is equal to your ordinary income tax rate, also known as your income tax bracket. Long-term capital gains tax rates typically apply if you owned the asset for more than a year. The rates are much less onerous; many people qualify for a 0% tax rate. Everybody else pays either 15% or 20%.

How long do I have to buy another property to avoid capital gains?

Within 180 days

How Long Do I Have to Buy Another House to Avoid Capital Gains? You might be able to defer capital gains by buying another home. As long as you sell your first investment property and apply your profits to the purchase of a new investment property within 180 days, you can defer taxes.

What is a simple trick for avoiding capital gains tax on real estate investments?

Use a 1031 Exchange

A 1031 exchange, a like-kind exchange, is an IRS program that allows you to defer capital gains tax on real estate. This type of exchange involves trading one property for another and postponing the payment of any taxes until the new property is sold.

What is the 2023 capital gains tax rate?

For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300. Above that income level the rate climbs to 20 percent.

How to (Legally!) Avoid Capital Gains Taxes on Real Estate https://t.co/KiVEhDg4Fs

— BiggerPockets (@BiggerPockets) October 30, 2019

How much is IRS capital gains tax on real estate?

The gain or loss is the difference between the amount realized on the sale and your tax basis in the property. The capital gain will generally be taxed at 0%, 15%, or 20%, plus the 3.8% surtax for people with higher incomes.

Frequently Asked Questions

How are capital gains taxed in an estate?

Capital gains taxes: These are taxes paid on the appreciation of any assets that an heir inherits through an estate. They are only levied when you sell the assets for gain, not when you inherit. Cash that you inherit is taxed through either inheritance taxes (when applicable) or estate taxes.

What is the capital gains tax on $200 000?

= $

Jan 11, 2023

| Single Taxpayer | Married Filing Jointly | Capital Gain Tax Rate |

|---|---|---|

| $0 – $44,625 | $0 – $89,250 | 0% |

| $44,626 – $200,000 | $89,251 – $250,000 | 15% |

| $200,001 – $492,300 | $250,001 – $553,850 | 15% |

| $492,301+ | $553,851+ | 20% |

What is considered capital gains on real estate?

Capital gains are the profits received when selling an asset, such as real estate, which can include your home, as well as commercial and rental property. Taxpayers pay capital gains tax based on the period of ownership and, when selling a personal residence, the length of time lived in the home.

FAQ

- Is profit from selling a house considered capital gains?

- Capital gains taxes can apply to the profit made from the sale of homes and residential real estate. The Section 121 exclusion, however, allows many homeowners to exclude up to $500,000 of the gain from their taxable income. Homeowners must meet certain ownership and home use criteria to qualify for the exemption.

- What is the IRS capital gains tax rate on real estate?

- 25 percent capital gains rate for certain real estate The IRS wants to recapture some of the tax breaks you've been getting via depreciation throughout the years on assets known as Section 1250 property.

What are capital gains taxes on real estate

| What is the capital gains on real estate | Aug 25, 2023 — There can be capital gains taxes on home or real estate sales, which means profit on the sale of your home might be taxed. |

| How much are capital gains taxes on real estate | The capital gain will generally be taxed at 0%, 15%, or 20%, plus the 3.8% surtax for people with higher incomes. However, a special rule applies to gain on the |