Since 1989, PNTN has been supporting law firm delivered title and legal services. Learn more about what PNTN can do for homeowners, lenders, and realtors

What are the taxes paid out by anyone who earns an income?

Individual Income Taxes

An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns.

What are taxes paid by businesses on land structures and other property they own called?

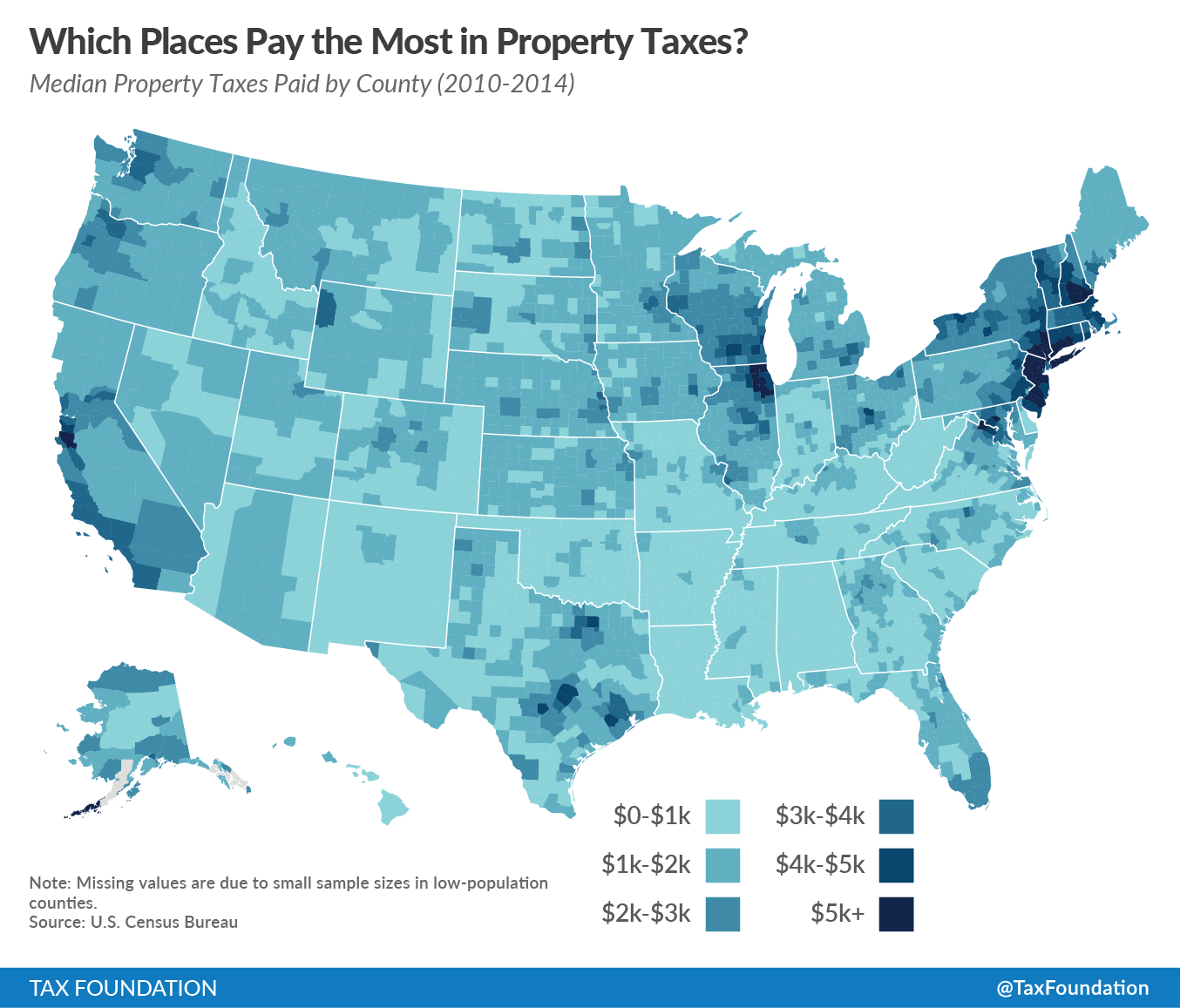

A property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

What are property taxes called quizlet?

These taxes are called "Ad Valorem."

What is any income that is generated by working?

Examples of earned income are: wages; salaries; tips; and other taxable employee compensation. Earned income also includes net earnings from self-employment.

What are the 3 main types of taxes?

Tax systems in the U.S. fall into three main categories: Regressive, proportional, and progressive.

CJI: The women contributed and gave such important suggestions for the drafting of the Constitution #Supremecourt

— Bar & Bench (@barandbench) January 11, 2023

Who is in charge of property taxes in Texas?

Texas has no state property tax.

The Texas Constitution and statutory law authorizes local governments to collect the tax. The state does not set tax rates, collect taxes or settle disputes between you and your local governments.

Frequently Asked Questions

Who pays property taxes at closing in Florida?

The seller

Property taxes: The seller is responsible for paying the property taxes up to the time of closing. Closing costs: This is a catch-all term for any other fees that may be associated with the sale of a property, such as attorney fees, document preparation fees, and more.

What are property taxes based on quizlet?

The property taxes are based on the assessed value of the property.

Which of the following is an encumbrance that affects the physical use of real property?

Encumbrances that affect the physical condition or use of the property. Examples are easements, building restrictions and zoning requirements, and encroachments.

Which of the following best describes what property taxes?

Most commonly, property tax is a real estate ad-valorem tax, which can be considered a regressive tax. It is calculated by a local government where the property is located and paid by the owner of the property. The tax is usually based on the value of the owned property, including land.

How do you read a comparable sales report?

Your property characteristics are listed from top to bottom. The comparable properties are listed to the right of the subject in the columns labeled “Comp 1, Comp 2,” etc. The property characteristics for each of the comparables are also listed from top to bottom.

What is fair condition for a house?

Fair to Average: Homes that are in need of moderate repair, refinishing, and/or renovation required; some items in satisfactory condition. Average: Homes that are typically encountered more frequently than residences of other conditions.

FAQ

- What is the value assigned to a property for tax purposes?

- Assessed value is the dollar value assigned to a home or other property for tax purposes. It takes into consideration comparable home sales, location, and other factors. Assessed value is not the same as fair market value (what the property could sell for) but is often calculated as a percentage of it.

- What is the abbreviation for land value?

- Understanding the Land Value Tax A land value tax (LVT) is intended to fairly value land, which is a finite asset with a base value that does not change as dramatically as the structures built upon the land.

- Who pays the real estate taxes for a condominium quizlet?

- -in the condominium form of ownership, each individual unit is owned separately and the taxes are paid by the individual owner.

- Do condo owners pay property tax in Texas?

- In general, condo owners are responsible for paying their property taxes, like any other homeowner. The local government assesses the value of each condo unit and levies taxes accordingly. In some cases, however, shared amenities or common areas within the condominium complex require additional taxation.

- How do property taxes work in North Carolina?

- There is no state property tax in North Carolina, which means tax rates are determined entirely by local governments. Cities and counties can levy their own taxes, and special tax districts in some areas also collect property taxes for services like fire protection.

- Do you pay property taxes on a condo in NYC?

- Tax rates vary depending on property type. For 2021, the tax rate for houses is 21.045% and for co-ops and condos it is 12.267%. Abatements, Exemptions and STAR - These reduce your property tax bill. For more information, check out our posts on tax abatements and the STAR program.

Taxes paid by anyone who owns property such as land a home or commercial real estate

| What is the most common reason a property fails to sell? | The most common reason a property fails to sell is an unreasonable asking price by the seller. |

| What is the definition of real property in the tax code? | Unless the California Constitution or federal law specifies otherwise, all property is taxable. Property is defined as all matters and things—real, personal, and mixed—that a private party can own. Real property is defined as: The possession of, claim to, ownership of, or right to the possession of land. |

| What is the definition of personal property in Texas tax code? | "Tangible personal property" means personal property that can be seen, weighed, measured, felt, or touched or that is perceptible to the senses in any other manner, and, for the purposes of this chapter, the term includes a computer program and a telephone prepaid calling card. Acts 1997, 75th Leg., ch. 1040, Sec. |

| What is the definition of market value in Texas tax code? | (7) "Market value" means the price at which a property would transfer for cash or its equivalent under prevailing market conditions if: (A) exposed for sale in the open market with a reasonable time for the seller to find a purchaser; (B) both the seller and the purchaser know of all the uses and purposes to which the ... |

| What is the property tax code 26.15 in Texas? | (f) If a correction that decreases the tax liability of a property owner is made after the owner has paid the tax, the taxing unit shall refund to the property owner who paid the tax the difference between the tax paid and the tax legally due, except as provided by Section 25.25(n). |

| Where can I read the tax code? | Internal Revenue Code The sections of the IRC can be found in Title 26 of the United States Code (26 USC). An electronic version of the current United States Code is made available to the public by Congress. Browse "Title 26—Internal Revenue Code" to see the table of contents for the IRC. |

- How does owning real estate impact your taxes?

- Depreciate Costs Over Time As a real estate investor that holds income-producing rental property, you can deduct depreciation as an expense on your taxes. That means you'll lower your taxable income and possibly reduce your tax liability.

- What happens to property taxes in a recession?

- Contrary to the mainstream perception, we find that the recession had a small but negative and lasting impact on the tax base. Negative shocks were offset by as much as 80-85% in the long run, implying that a 10% decrease in the tax base lead to only a 1.5% decline in property tax revenues.

- Are property taxes efficient?

- It is a well-known result in economics that land value taxation is efficient since it does not distort the supply of the tax base.

- Is buying a house a tax write off?

- As a newly minted homeowner, you may be wondering if there's a tax deduction for buying a house. Unfortunately, most of the expenses you paid when buying your home are not deductible in the year of purchase. The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest (points).

- What are the benefits of real estate?

- The benefits of investing in real estate include passive income, stable cash flow, tax advantages, diversification, and leverage. Real estate investment trusts (REITs) offer a way to invest in real estate without having to own, operate, or finance properties.