Two years

In NYS under Article 11 of the Real Property Tax Law Foreclosure may begin after two years of delinquency on the taxes. However counties and cities have different policies and can extend that period to three to four years from the date of the delinquency.

Can I pay my NY property taxes online?

If you received a bill or notice and need to pay, you have options: use your Online Services account to pay directly from your bank account for free or by credit card for a fee. Don't have an Online Services account? Pay directly from your bank account for free using Quick Pay (individuals only).

How do I pay back taxes?

- Set up an installment agreement with the IRS. Taxpayers can set up IRS payment plans, called installment agreements.

- Request a short-term extension to pay the full balance.

- Apply for a hardship extension to pay taxes.

- Get a personal loan.

- Borrow from your 401(k).

- Use a debit/credit card.

How do I get a copy of my property tax bill in NY?

You can always download and print a copy of your Property Tax Bill on this web site. If you lost the original bill, and are making a payment, you can pay electronically or print out and send in the online copy with your tax payment. You do not need to request a duplicate bill.

What happens if you don't pay your property taxes in NY?

In New York State, property taxes are collected semi-annually by your county. Each county has their own protocols about what to do with delinquent property taxes, but they usually follow a similar path. After a specific deadline, if you still haven't paid your taxes, your county will issue a tax lien on your property.

How the rich use real estate to avoid taxes?

Property owners can borrow against the home equity in their current property to make other investments. Depending on the property sale value, home-owners can be excluded from capital gains taxes on the gains of their home sale. Individuals are also able to deduct the interest paid on their mortgages.

Give me a chance & New Yorkers won’t beg for anything... we will cut property taxes 30%, end the corruption stealing from NY & fix our streets, bridges & transit system. POLLS ARE OPEN. Vote #MolinaroForNY #MolinaroForGovernor https://t.co/B361iuFHC6

— Marc Molinaro #NY19 🇺🇸 (@marcmolinaro) November 6, 2018

Who has highest real estate taxes?

- Rockford, Illinois. The median annual real estate taxes paid in Rockford is $3,283.

- Waterbury, Connecticut. Waterbury homeowners pay an average of 2.75%.

- Bridgeport, Connecticut.

- Aurora, Illinois.

- Elgin, Illinois.

- Rochester, New York.

- Syracuse, New York.

- Peoria, Illinois.

Frequently Asked Questions

What are the top 2 ways rich people use to legally avoid paying taxes?

- Foundations.

- Gifting.

- Family offices.

- Investments.

- Moving residency.

Who has the worst property taxes?

How do real estate taxes work in NYC?

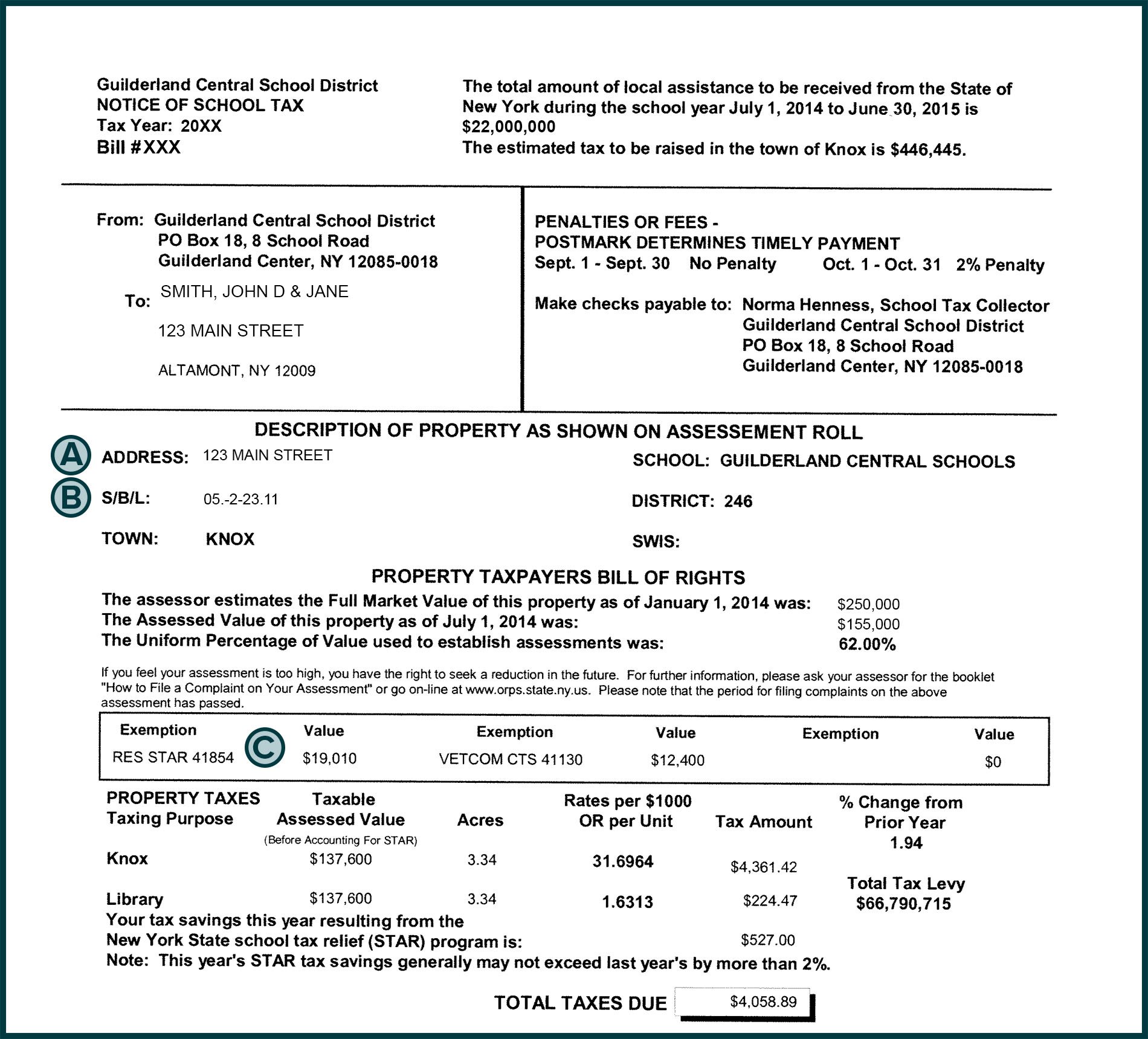

The amount of your property tax bill is based on your property's taxable assessment and local tax rates. Local governments determine tax rates by dividing the total amount of money that has to be raised from the property tax (the tax levy) by the taxable assessed value of real property in the municipality.

How do I find my property tax bill in NYC?

What is the average property tax bill in NYC?

Due to Manhattan's high real estate values, the average homeowner pays $8,980 in annual property taxes, whereas the statewide median payment is $5,732.

FAQ

- How do the rich avoid taxes through real estate?

- Taking Advantage of 1031 Exchanges

The 1031 exchange, named for Section 1031 of the Internal Revenue Code, allows investors to defer taxes by selling one investment property and using the equity to purchase another property or properties of equal or greater value.

- What happened with Trump's taxes?

But Trump posted a massive $4.8 million adjusted loss in 2020, a year, which alone wiped out his federal income tax obligation. Trump paid $0 in federal income taxes in 2020.

- Did Trump eliminate mortgage interest deduction?

That massive number is the reduction in home values caused by the 2017 tax law that capped federal deductions for state and local real estate and income taxes at $10,000 a year and also eliminated some mortgage interest deductions.

- How billionaires use loans to avoid taxes?

Let's discuss this: The “buy, borrow, die” strategy is an estate planning tool the wealthy use to minimize the taxes they owe. The idea is to purchase investments that appreciate in value, borrow against those assets, and use them as collateral for loans, then pass on those assets to heirs tax-free.

- How many rental property should one own?

When it comes to answering that question, there's no universal answer other than, “1 or more”. If you haven't purchased your first rental property yet, start at 1. Regardless of your investment experience, the best answer for you is going to come down to your goals.

How to pay nys real estate tax for 2018

| What is the 50% rule in rental property? | The 50% rule or 50 rule in real estate says that half of the gross income generated by a rental property should be allocated to operating expenses when determining profitability. The rule is designed to help investors avoid the mistake of underestimating expenses and overestimating profits. |

| What is the 2 rule for rental properties? | 2% Rule. The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000. |

| What is the 80 20 rule for rental property? | For example, if 80% of your profits come from 20% of your real estate investments, then you should focus on that investment type. The 80-20 rule in real estate investments can help you identify your most valuable clients or partners. |

| What is the NYS 2023 property tax rebate? | The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is $250,000 or less. Most recipients of the School Tax Relief (STAR) exemption or credit were automatically qualified and have already received their rebates. |

- Can you claim property taxes on your tax return NY?

- If you file a New York State personal income tax return, complete Form IT-214, Claim for Real Property Tax Credit, and submit it with your return. If you are not required to file a New York State income tax return, but you qualify for this credit, just complete and file Form IT-214 to claim a refund of the credit.

- What is New York real property tax relief credit?

The real property tax credit was enacted by the state Legislature to help senior citizens and lower-income households cope with their property tax burden. If your gross income is $18,000 or less and you pay $450 or less for rent or own your own home, you may qualify for a tax credit.

- At what age do you stop paying property taxes in NY?

Eligibility Requirements

All owners of the property must be 65 or older, unless the owners are spouses or siblings. If you own the property with a spouse or sibling, only one of you must meet this age requirement. The total combined annual income of the property owner and spouse or co-owner cannot exceed $58,399.

- What is the new tax credit for 2023?

The 2023 child tax credit is worth up to $2,000 per qualifying dependent under the age of 17. The credit is nonrefundable, but some taxpayers may be eligible for a partial refund of up to $1,600 through the additional child tax credit when they file in 2024.