10 Examples Of Real Estate Business Names

- Equitable Property Group.

- Landmark Realty Group.

- Pinnacle Real Estate.

- Beacon Homes LLC.

- Sequoia Real Estate.

- Blue Sky Realty.

- Titan Real Estate.

- Platinum Property Advisors.

How do I name my real estate business?

8 tips for coming up with a strong real estate business brand name

- Avoid puns.

- Watch out for trademarks.

- Keep it simple.

- Be original.

- Use a business name generator.

- Imagine what your name will look like in a design.

- Think about your location.

- Stand out.

What are some good LLC names?

75 Best LLC Company Names, Ideas, and Examples

- Shimmering Beauty.

- The Career Coach.

- Phoenix LLC.

- ExeCuteIve.

- Roll It Up.

- Joyous.

- Mentor LLC.

- Squeaky Clean.

What are the cons of owning property in LLC?

The key drawback to an LLC is costs: legal fees, insurance and mortgages. First, one will incur legal fees in making sure the LLC is properly formed and maintained. Second, insurance premiums for the property held by the LLC will likely be higher than insurance for the property if it is held in one's own name.

Should LLC name be unique?

It must be unique.

Legally, the name of your LLC can't be the same as another business entity registered in your state or the same as a trademarked phrase. State databases check only whether the LLC name is available in your own state, but do not check whether the name is trademarked.

Should I put my investments in an LLC?

The management flexibility, tax benefits and protection of personal assets offered by LLCs make it a great vehicle for investment opportunities. Since there can be more than one member, it's often the business entity of choice when multiple people are looking to invest in something as a group.

10. LLC or personal name for real estatehttps://t.co/zgfSD6tVhQ

— TheWealthCoach (@indexnforgetit) December 21, 2022

Do investors go on the LLC?

If you structured your business as a limited liability company, you can bring in investors – individuals, corporations and partnerships – to raise capital for your business.

Frequently Asked Questions

Why do investors not like LLCs?

One is because an LLC is taxed as a partnership (pass-through taxation) and will complicate an investor's personal tax situation. By becoming a member of the LLC to invest in it, the investor will be taxed on the LLC's profits even if receiving no cash distribution personally.

What are the pros and cons of an LLC?

An LLC has pros such as flow-through taxation and limited liability protection. However, there are also disadvantages such as the legal process of “piercing the corporate veil” and being forced to dissolve the LLC if a member leaves.

What are 5 disadvantages of LLC?

Disadvantages of an LLC

- Liability limited by business assets.

- The ability of the business to remain in existence if a shareholder departments.

- The creation of a centralized management structure.

- Flexible asset transfer.

What are the pros and cons of buying an LLC?

An LLC has pros such as flow-through taxation and limited liability protection. However, there are also disadvantages such as the legal process of “piercing the corporate veil” and being forced to dissolve the LLC if a member leaves.

FAQ

- What is the best business entity for a realtor?

- Recently, one of our real estate clients asked me what the best business structure for her to use was. Every business structure has advantages and disadvantages; however, for most real estate agents and brokers, using an S corporation or LLC is the best option.

- Which is the best business structure for real estate investors?

- In fact, many experts will always recommend that real estate investors use LLCs for their real estate investments. However, whether an LLC is appropriate for your investment is still a personal decision. Real estate investors must file the necessary formation documents to create an LLC in the state of their choosing.

- Why would someone use an LLC instead of as corporation?

- LLCs are common because they provide the liability that's similar to a corporation, but they are easier to establish and with fewer regulatory requirements than other types of corporations. LLCs allow for personal liability protection, which means creditors cannot go after the owner's personal assets.

- Which type of real estate business is most profitable?

- Commercial properties are considered one of the best types of real estate investments because of their potential for higher cash flow. If you decide to invest in a commercial property, you could enjoy these attractive benefits: Higher-income potential.

How to name an llc for real estate

| Why setup an LLC for investing? | Since their creation, LLCs have been used to house real estate investments (especially rental property) to keep the investor's personal assets safe. Since an LLC is a separate entity from the owner/member, only the assets held by the LLC are up for grabs if it ever gets sued or the LLC's property is foreclosed upon. |

| Can real estate commissions be paid to an LLC in New York? | New York State allows associate brokers and salespersons to individually form an L.L.C. (limited liability company). The broker may pay a commission to an L.L.C. |

| Why form an LLC in NY? | An LLC may organize for any lawful business purpose or purposes. The LLC is a hybrid form that combines corporation-style limited liability with partnership-style flexibility. The flexible management structure allows owners to shape the LLC to meet the needs of the business. |

| What are the tax benefits of a real estate holding company? | A holding company prevents double taxation on investment properties. The business structure allows investors to more easily manage their properties. As a whole, LLCs pay less fees when compared to corporations. Holding companies provide investors with more flexibility to distribute their profits. |

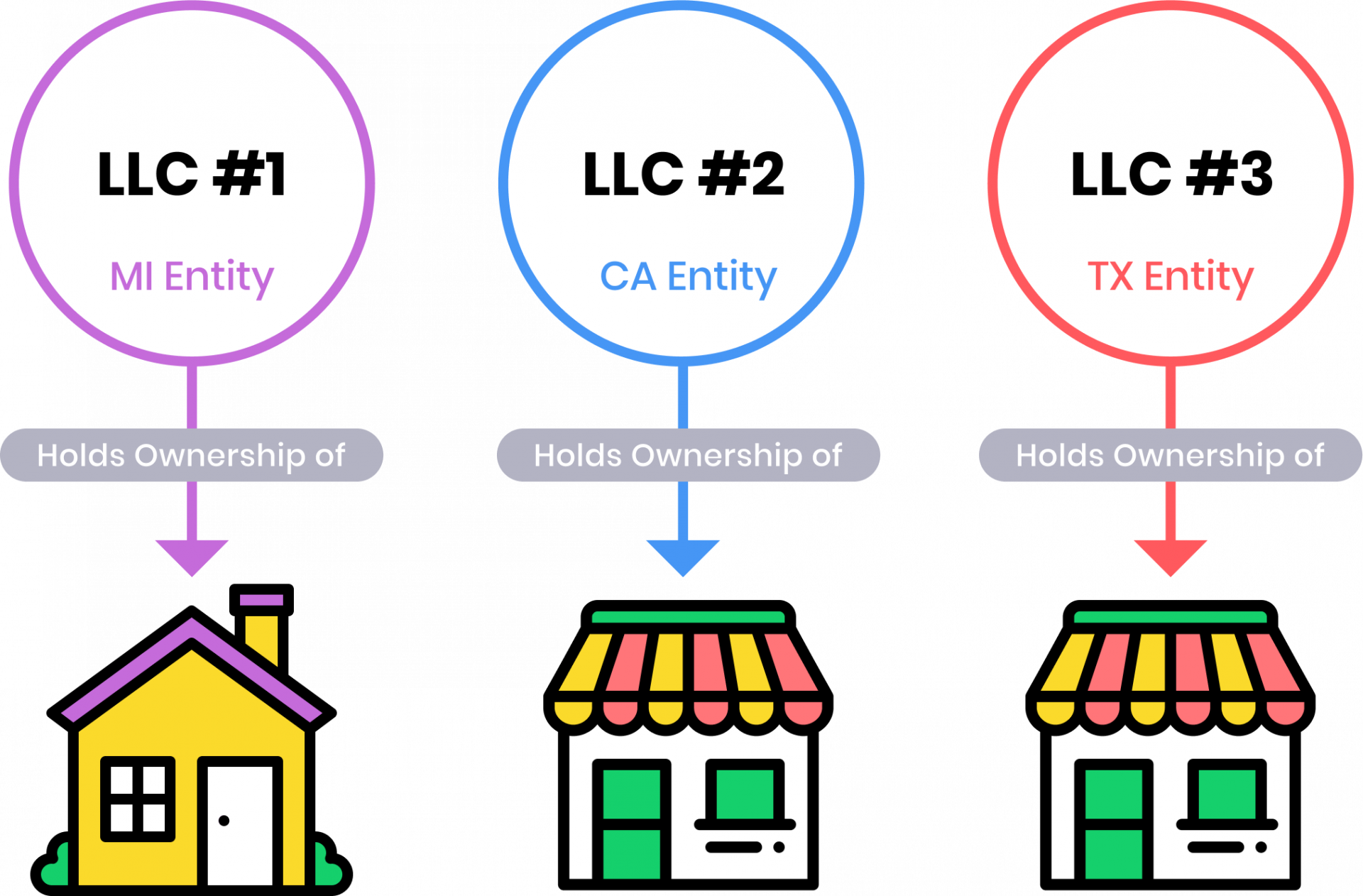

- Why would one person have multiple LLCs?

- It's not actually unusual to have multiple LLCs, either as a sole owner or as one of a group of owners, or "members," as they are called in an LLC. Owning more than one LLC may make sense if: Separate businesses. If you have two separate businesses, two LLCs can minimize your risk if one business fails.

- Why do rich people buy houses with LLC?

- Privacy: If you own a real estate investment business, having an LLC is beneficial to you because it allows you to separate your personal life from your business. Instead of your name and info on the paperwork, it's the LLCs. Tax benefits: LLCs remove the possibility of double taxation.

- Why do celebrities buy houses under LLC?

- It can help with privacy, so that people wouldn't know who owns the property. To protect their property from lawsuits. To protect their property from being taken through marital divorce.

- How many LLCs is too many?

- As long as the businesses are distinct and separate, there is no limit to how many LLCs a single individual can create. A business owner has to comply with the formation requirements for every LLC that he creates. To form an LLC one has to file a Certificate of Organization, separate for each LLC.