Property tax prepayment

When you prepay, the money is held in an escrow account and applied to your property taxes before tax bills are mailed. Prior year taxes must be paid before you can begin escrowing payments.Can you prepay property taxes in NY?

Can you prepay property taxes in California?

Are NYC property taxes deductible?

Real estate taxes are generally divided so that you and the seller each pay taxes for the part of the property tax year you owned the home. Your share of these taxes is fully deductible, as long as you itemize your deductions.

What year do you stop paying property taxes in Texas?

Property Tax and Appraisals

The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

How do I pay my NYS estimated taxes?

You may pay your estimated tax or your bill directly from your bank account using your Online Services account. If you have not created an Online Services account, please create one as an individual, business or tax professional and then login.

Should You Prepay Your 2018 Property Taxes? Some helpful advice from @jillonmoney @CBSThisMorning https://t.co/Eg87lGrJA4 pic.twitter.com/Qi0J8HClP9

— WBZ | CBS News Boston (@wbz) December 28, 2017

At what age do you stop paying property taxes in New York State?

65 years of age or over

Each of the owners of the property must be 65 years of age or over, unless the owners are: husband and wife, or.

Frequently Asked Questions

Can I pay estimated tax early?

If you're not subject to an underpayment penalty — meaning the two situations above apply to your situation — you can also pay your taxes early. However, there's no additional benefit to paying your taxes early.

Who pays commercial rent tax in NYC?

Tenants

This tax is charged to tenants who occupy or use a property for commercial activity in Manhattan, south of the center line of 96th Street and pay at least $250,000 each year in rent.

How do I pay my property taxes in NYC?

- Online through CityPay.

- Directly from your bank account with Electronic Funds Transfer (EFT)

- By phone.

- By mail.

- In person at a DOF Business Center.

- Through a bank or bill pay website.

How are NYC property taxes paid?

You can pay your property taxes with your checking or savings account through Electronic Funds Transfer (EFT). EFT transfers funds from your bank account to the Department of Finance's bank account.

Is property tax paid every year in US?

Do You Pay Property Taxes Monthly Or Yearly? Every homeowner pays taxes based on their home's value and the property tax rates for the county or city. Most areas charge property taxes semiannually, and you pay them in arrears. For example, in 2021, you'd pay the property taxes for 2020.

How often do you pay property tax New York?

Four times a year

The Department of Finance mails property tax bills four times a year. You will pay your property taxes two or four times a year, depending on the property's assessed value. Bills are generally mailed and posted on our website about a month before your taxes are due.

What agency in NYC is in charge of taxes?

Department of Taxation and Finance.

How are property taxes determined in NYC?

The amount of your property tax bill is based on your property's taxable assessment and local tax rates. Local governments determine tax rates by dividing the total amount of money that has to be raised from the property tax (the tax levy) by the taxable assessed value of real property in the municipality.

FAQ

- When did property tax start in NY?

The real property tax dates back as early as 1654 to the Dutch New York Colony. The history of the laws relating to the real property tax in New York State is, for the most part, a history of efforts of New Yorkers to achieve equality in the apportionment of property tax levies among property owners.

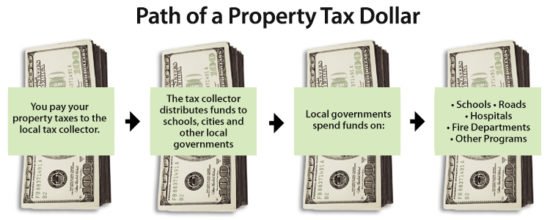

- Who imposes property taxes in us?

Local governments

Taxpayers in all 50 states and the District of Columbia pay property taxes, but the tax on real property is primarily levied by local governments (cities, counties, and school districts) rather than state governments. With a few exceptions, states typically levy taxes on personal property.- How does the New York tax system work?

New York state income tax rates range from 4% to 10.9%. Tax brackets and rates depend on taxable income, adjusted gross income and filing status. Residency status also determines what's taxable. These rates apply to income earned in 2022 that was reported on tax returns due in 2023.

- Can I pay my NYC property tax monthly?

Paying your property tax is about to get a lot easier.

You can now register to pay your bill monthly, instead of quarterly, semi-annually, or annually. Why choose monthly?- How do I prepay estimated taxes?

You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. You can also make your estimated tax payments through your online account, where you can see your payment history and other tax records. Go to IRS.gov/account.

- What is the difference between NYS STAR exemption and STAR credit?

The STAR program is separate from HTRC, and STAR benefits are granted in the form of either: a STAR exemption, which is a reduction on your school tax bill; or. a STAR credit, which is paid to you by check or direct deposit.

- How much is NYS enhanced STAR exemption?

Enhanced STAR

$93,200 or less for the 2023-2024 school year. $98,700 or less for the 2024-2025 school year.

How to know if you should prepay 2017 real estate taxes

| Do you have to apply for NY Star credit every year? | You don't need to register again unless there's been a change in the ownership of your home. (See the list of who should update their registration above.) We'll review your information every year and automatically issue a STAR credit to you if you're eligible. |

| What is the star tax abatement in NYC? | You can use your STAR benefit to pay your school taxes. You can receive the STAR credit if you own your home and it's your primary residence and the combined income of the owners and the owners' spouses is $500,000 or less. STAR exemption: a reduction on your school tax bill. |

| What is the difference between NYS homeowner tax rebate and star? | What's the difference between the HTRC and STAR? The HTRC was a one-year program to provide property tax relief in 2022. The STAR program is an ongoing program to provide school tax relief to qualifying homeowners. To learn more, see STAR resource center. |

| What is the enhanced real property tax credit in NYC? | The Enhanced Real Property Tax for NYC Residents The Enhanced Real Property Tax Credit is available to NYC residents who have a household gross income of less than $200,000 and pay either real property taxes or rent for their residences. The credit can be as much as $500. |

| What is the enhanced star credit in NY? | Enhanced STAR provides an increased benefit for the primary residences of senior citizens (age 65 and older) with qualifying incomes: $93,200 or less for the 2023-2024 school year. $98,700 or less for the 2024-2025 school year. |

| Are New York City residents who earn under $200000 eligible for up to a $500 credit? | The New York City enhanced real property tax credit may be available to New York City residents who have household gross income of less than $200,000, and pay real property taxes or rent for their residences, or both. The credit can be as much as $500. |

| Who qualifies for NYC Enhanced Star? | Normally, to be eligible for Enhanced STAR, all of the property owners must be at least 65 years of age. However, when property is jointly owned by a married couple, only one spouse needs to be at least 65 years of age. |

- What is the senior property tax credit in NYC?

The Senior Citizen Homeowners' Exemption (SCHE) provides a reduction of 5 to 50% on New York City's real property tax to seniors age 65 and older. To be eligible for SCHE, you must be 65 or older, earn no more than $58,399 for the last calendar year, and the property must be your primary residence.

- What month are property taxes due in NY?

If your property's Assessed Value is:

Bills are mailed: Quarterly (4 times a year). Payment is due on: July 1, October 1, January 1 and April 1.

- How do I pay my property taxes in Suffolk County NY?

Department of Audit and Control

Suffolk County Comptroller is pleased to announce the acceptance of all major credit cards – VISA, MasterCard, American Express, and Discover, as well as e-checks – for the payment ofoutstanding property taxes.

- What are the property taxes in Suffolk County NY?

In Long Island, the two main counties to consider are Nassau and Suffolk County. In Nassau County, you can expect to pay an average of 2.24% of your home's assessed fair market value. Suffolk County is a fraction more expensive, clocking in at an average of 2.3% of the assessed fair market value.

- What town on Long Island has the lowest property taxes?

What town on Long Island has the lowest property taxes? The Sagaponack school district in Southampton, Suffolk County has the lowest property taxes in Long Island compared to value with an effective tax rate in New York at $3.93 per $1,000 – but very high home values.

- How do you pay property taxes in NY?

- It is recommended that you pay your property taxes online with CityPay.

- Online through CityPay.

- Directly from your bank account with Electronic Funds Transfer (EFT)

- By phone.

- By mail.

- In person at a DOF Business Center.

- Through a bank or bill pay website.

- It is recommended that you pay your property taxes online with CityPay.

- How do I get a copy of my property tax bill in NY?

You can always download and print a copy of your Property Tax Bill on this web site. If you lost the original bill, and are making a payment, you can pay electronically or print out and send in the online copy with your tax payment. You do not need to request a duplicate bill.