- Personalize. Always.

- Optimize for deliverability.

- Use a hierarchy for readability.

- Fulfill the promise.

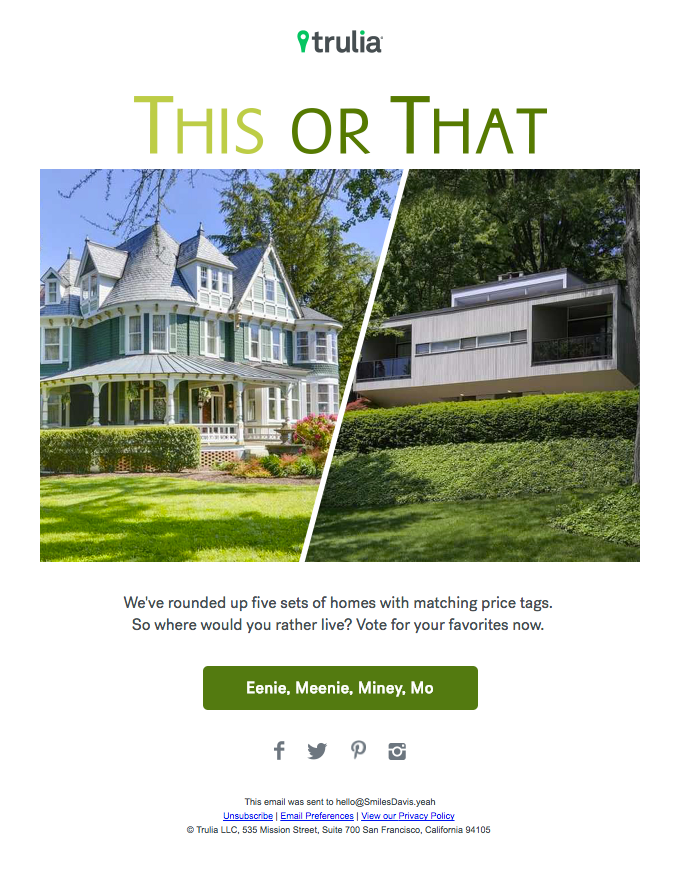

- Get creative with dynamic content.

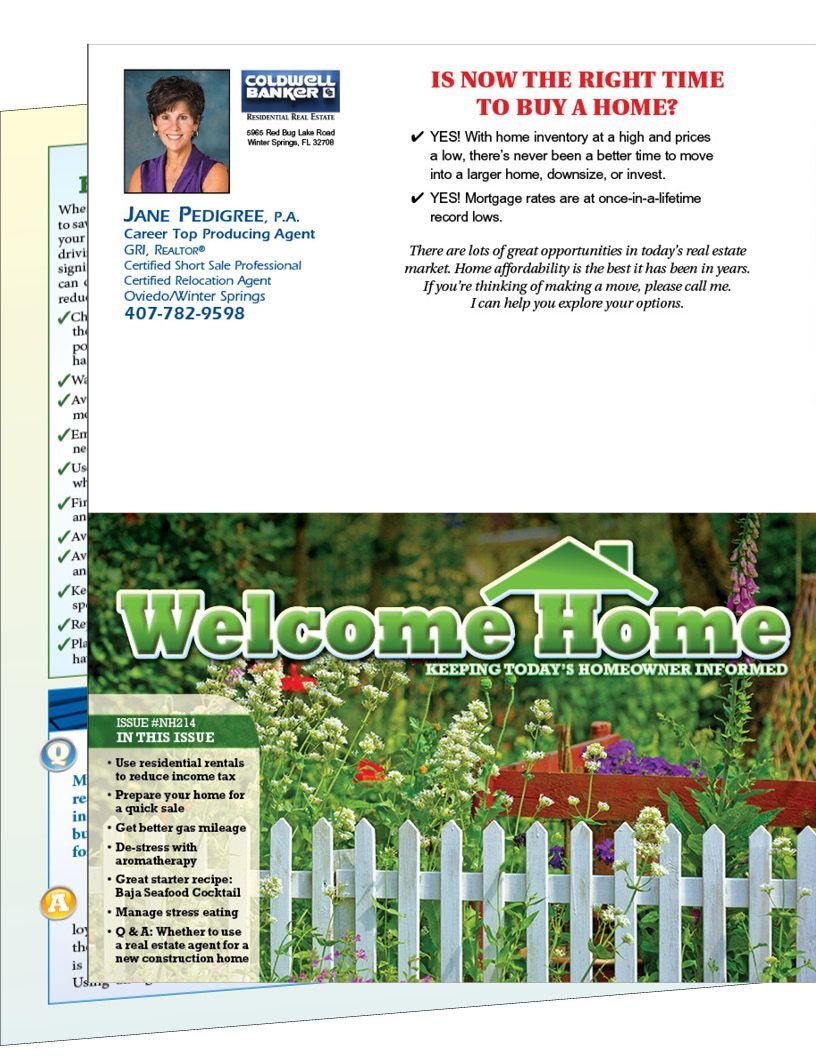

- Highlight your branding.

- Don't overwhelm with options.

- Make it all about them.

What do you say in a real estate newsletter?

- Tips, information, and insights about home buying and selling.

- Guides to community resources and events.

- Stories about local businesses in the neighborhoods you serve.

What should be included in a monthly real estate newsletter?

- A featured listing of the week or a weekly market update.

- A how-to article about DIY home repair.

- Key terms real estate buyers and sellers need to know.

- The renovations that produce the highest ROIs.

- Local businesses that specialize in “X” type of repair or service.

What should be the goal of your real estate newsletter?

Since most of your audience has the attention span of a flea, the first goal of your real estate newsletter should be to keep them engaged. Focus on fun content like a wrap-up of cool neighborhood pictures from Instagram.

How do you make a catchy newsletter?

- Focus On Offering Value. Offer value, period.

- Keep It Short, Authentic And Actionable.

- Test For The Right Frequency.

- Write For Your Audience, Not For You.

- Use Clever And Relevant Headlines.

- Create Content Worth Reading.

- Curate Engaging Elements.

- Run Special Editions.

How do I calculate yield?

- = Dividends per Share / Stock Price x 100.

- = Coupon / Bond Price x 100.

- = Net Rental Income / Real Estate Value x 100 (also called “Cap Rate“)

I need a real estate investing mentor.

— Jason Benn 🏡 (@jasoncbenn) July 19, 2023

I figured out how to materialize tenant communities out of thin air (https://t.co/q8qQoycr1z), but that's only half of the equation: I have no idea how to find a good investment and buy it.

How do I find this person?

What is the formula for equity yield in real estate?

Return on equity is calculated using a formula of net income divided by shareholder's equity. In real estate, the formula is better described as cash flow after taxes divided by the sum total of initial cash investment plus any additional equity that has built up as you've made mortgage payments.

Frequently Asked Questions

What is the formula for overall yield?

Note that if a synthesis is a linear multistep process, then the overall yield is the product of the yields of each step. So for example, if a synthesis has two steps, each of yield 50% then the overall yield is 50% x 50% = 25%.

How do you calculate annual yield on investment property?

Calculating Net Rental Yield

Net rental yield's formula adds in an essential part of business planning: your expenses. Net rental yield = (Annual rental income – operating expenses) / property value x 100.

How to calculate yield?

- = Dividends per Share / Stock Price x 100.

- = Coupon / Bond Price x 100.

- = Net Rental Income / Real Estate Value x 100 (also called “Cap Rate“)

How do you calculate net rental real estate income?

As the formula states, you simply subtract your operating expenses from the gross income to figure out the net operating income. It's important to note that the NOI formula does not consider the property's financing expenses, such as the mortgage payment and interest.

How do you calculate net initial yield?

How to calculate net yield?

Net yield is calculated by taking the annual rental income, deducting any costs and then dividing by the purchase price of a property.

What should I include in my real estate newsletter?

- Rental vs. Purchase Advice.

- Buyer/Seller Search Guide. People who choose to sell a home and buy a new one at the same time have special sets of challenges to face during the real estate process.

- Homebuying Apps and Resources.

- Relocation Tips.

- Home Staging Tips.

- Home Inspection Guide.

How can I start my newsletter?

- Develop an email marketing strategy.

- Use the right email marketing software.

- Make an email subscription form.

- Encourage site visitors to subscribe.

- Create a landing page for your newsletter.

- Build segmented email lists.

- Design your newsletter.

- Write the newsletter content.

What are the 9 steps to make a newsletter?

- Produce good content. Make sure your content is engaging and useful.

- Establish branding.

- Brevity is the soul of wit.

- Be informative without being too salesy.

- Add photos and graphics.

- Optimize your text formatting.

- Use interactivity in Lucidpress.

- Proofread your newsletter.

How do I grow my real estate email list?

- The importance of good real estate agent email lists.

- Build a landing page.

- Tools to help you grow the list.

- Add a sign-up link to your email signature.

- Add a sign-up form to your website.

- Facebook and Instagram ads.

- Tips on how to do the most out of your realtor's email list.

- Keep your audience updated with the latest news.

What should not be included in a newsletter?

- Generic Subject Lines.

- Poorly Written Content.

- Over-doing Links and Calls to Action (CTA)

- Appeal to a Specific Audience.

- Use a Template.

- Ask your Readers to Invite Others to Subscribe.

FAQ

- What is yield in the housing market?

Rental yield compares the cash generated by a property as a percentage of the property price or market value. Of the many financial metrics that real estate investors use to analyze property, rental yield is a quick and easy tool to help identify properties that offer the most profit potential.

- What is the 2% rule in real estate?

2% Rule. The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

- What is the formula to calculate yield?

How Is Yield Calculated? To calculate yield, a security's net realized return is divided by the principal amount.

- What is yield vs return in real estate?

Yield is the amount an investment earns during a time period, usually reflected as a percentage. Return is how much an investment earns or loses over time, reflected as the difference in the holding's dollar value.

- What should I put in my real estate newsletter?

- 6 Homebuying and Selling Content Ideas

- Rental vs. Purchase Advice.

- Buyer/Seller Search Guide. People who choose to sell a home and buy a new one at the same time have special sets of challenges to face during the real estate process.

- Homebuying Apps and Resources.

- Relocation Tips.

- Home Staging Tips.

- Home Inspection Guide.

- What content should go in a newsletter?

- Check out these business information newsletter ideas you can send subscribers to educate them about your business and brand.

- Share Your Company Story.

- Behind-The-Scenes Tour.

- Employee of the Month.

- Job Postings.

- Frequently Asked Questions.

- Industry News.

- Interview an Expert.

- How do I create a monthly newsletter for real estate?

- How to create a real estate newsletter that drives sales?

- Personalize. Always.

- Optimize for deliverability.

- Use a hierarchy for readability.

- Fulfill the promise.

- Get creative with dynamic content.

- Highlight your branding.

- Don't overwhelm with options.

- Make it all about them.

- Do real estate newsletters work?

Stay top of mind with potential clients

A real estate newsletter is a great way to do this. If done right, they are a consistent reminder of your expertise and professionalism. When the time comes for your subscribers to buy or sell a home, they are likely to come to you for help.

- How do you write a catchy newsletter?

- Guidelines for Writing a Compelling Newsletter

- Use a strong subject line.

- Include a clear call to action.

- Include hyperlinks.

- Keep it as brief as possible!

- Break up heavy text with bullets and lists.

- Include images.

- Be flexible and track your performance.

- How do I find topics for newsletters?

- 50 must-try newsletter ideas for your email content

- Favorable articles about your company.

- Business changes that impact customers.

- A company anniversary or milestone.

- Recent award nominations or wins.

- A list of open positions for hire.

- Monthly business recap.

- A behind-the-scenes look at your company.

- A message from the CEO.

- How do I create a realtor newsletter?

- How to create a real estate newsletter that drives sales?

- Personalize. Always.

- Optimize for deliverability.

- Use a hierarchy for readability.

- Fulfill the promise.

- Get creative with dynamic content.

- Highlight your branding.

- Don't overwhelm with options.

- Make it all about them.

How to do real estate neighborhood newsletters

| How do you make real estate content on Instagram? | 10 Powerful Ways to Use Instagram for Real Estate Marketing

|

| What to include in a real estate newsletter | Jul 4, 2019 — Do not forget that your newsletter is about you and your business as well. Be sure to mention any milestones or accomplishments to demonstrate |

| What should I put on my real estate blog? | Blogging About Your Local Real Estate Market

|

| What should a realtor post? | 80 Social Media Post Ideas For Real Estate

|

| What should I include in my monthly newsletter? | 50 must-try newsletter ideas for your email content

|

| What is the difference between yield and return on a property? | A high rental yield, expressed as a percentage, equals a greater cash flow. Return refers to past performance and is used by investors to determine what gain or loss has been made over a specified period. If you sell an asset for more than you paid for it, that is a capital gain/growth. |

| How can I start a newsletter? | Now, let's learn how to start a newsletter.

|

| How to create a newsletter step by step? | Click to jump ahead:

|

| What is a yield rate in real estate? | A yield rate is a rate of return on capital; it is usually expressed as a compound annual percentage rate. A yield rate considers all expected benefits from the property over the income projection period, including both annual net income and any remaining value or sale proceeds, at the termination of the investment. |

| What is a yield calculator? | The rental yield calculator allows you to work out the gross and net rental yields on any individual property or the entire portfolio of your lettings business. Rental yield based on Property Purchase Cost. Rental yield based on Current Property Value. |

| How is a yield calculated? | Yield calculation and formula The calculation for yield differs depending on the type of yield. The common formula is income (eg from dividends or interest payments) divided by investment value. This can then be multiplied by 100 to get a percentage figure. |

- Is a 20% yield good?

Think of percent yield as a grade for the experiment: 90 is great, 70-80 very good, 50-70 good, 40-50 acceptable, 20-40 poor, 5-20 very poor, etc.

- What is the formula for net yield in real estate?

Calculating Net Rental Yield

Take your monthly rental income (or estimated income) Multiply the monthly income by 12 to work out your annual gross income. Minus the total costs for the property over the year to work out your annual net income. Divide the resulting sum by the price you paid (or will pay) for the

- What is the net effective yield of a property?

Net equivalent yield (NEY) is the time weighted average return (after adding notional purchasers costs) that a property will produce.

- What is a yield percentage in real estate?

Definition. In the context of commercial real estate, yield refers to the annual income from the investment, expressed as a percentage of the investment's total cost (or some cases its estimated current value). Yield is another name for the rate of return. There are two types of yield: levered yield and unlevered yield

- How do I calculate my yield?

- Determine the market value or initial investment of the stock or bond. Determine the income generated from the investment. Divide the market value by the income. Multiply this amount by 100.

- Is 7% yield good?

As a rule of thumb, between 6% and 8% is considered to be a reasonable level of rental yield, but different parts of the country can deliver significantly higher or lower returns.

- What is the average ROI on rental property?

Residential properties generate an average annual return of 10.6%, while commercial properties average 9.5% and REITs 11.8%. Investors typically analyze data pertaining to specific geographic regions or metropolitan areas to compare returns and the cost of capital to inform their investment decisions.

- What is the yield of income in real estate?

Definition. In the context of commercial real estate, yield refers to the annual income from the investment, expressed as a percentage of the investment's total cost (or some cases its estimated current value). Yield is another name for the rate of return. There are two types of yield: levered yield and unlevered yield

- What is the yield of a real estate asset?

Real estate yield

This is a measurement of future income on an investment made on immovable property. It is calculated as a percentage, depending upon the cost of the property or its market value. The capital gain is not factored in here.

- What does 7.5% yield mean?

A property rental yield is the measure of the rental income in relation to the property's capital value expressed as a percentage. So, for example if the annual rent on a rental property was £7000 pa and the capital value £100,000 the rental yield on that property is 7%.

- How to calculate yield residential real estate

Nov 11, 2017 — To calculate the net rental yield, subtract the annual expenses from the annual rent and divide this result by the total cost of the investment