- ROI = (Annual Rental Income – Annual Operating Costs) / Mortgage Value.

- Cap Rate = Net Operating Income / Purchase Price × 100%

- Cash-on-Cash Return = (Annual Cash Flow / Total Cash Invested) × 100%

How do you calculate monthly rent?

We multiply the weekly rent by the number of weeks in a year. This gives us the annual rent. We divide the annual rent into 12 months which gives us the calendar monthly amount. Remember your rent is always due in advance so should you wish to pay monthly then your rent must be paid monthly in advance.

How do you calculate 2.5 times the rent?

I Need to Calculate 2.5x Rent

For example, if the monthly rent is $1,000, you should multiply it by 2.5. According to the 2.5x rent rule, this means the tenant should be earning at least $2,500 per month in gross income.

How accurate is Rentometer?

However, many property owners are aware that much more than just three data factors go into deciding a home's rent. As a result, Rentometer's statistics and data cannot be considered reliable if you're seeking precise, 100% correct data.

What is the 2% rule in real estate?

2% Rule. The 2% rule is the same as the 1% rule – it just uses a different number. The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

What is the formula to calculate rental fee?

The simplest way to determine how much rent to charge for a house is the 1% Rule. This general guideline suggests that you charge around 1% (or within 0.8-1.1%) of your home's total market value as monthly rent payments.

Ramit can afford to buy a house thanks to investing the difference between what it cost to rent vs. what it cost to own in HCOL cities, which for him was thousands of dollars every single month https://t.co/F2ZEVWf1Dw

— Ramit Sethi (@ramit) July 16, 2023

How to calculate rental price South Africa?

The accepted calculation standard for a long time has been to charge up to 1.1% of the property's value in relative terms. Take note that as the property's value increases the percentage of rental yield decreases because of the low demand for rental in high value properties.

Frequently Asked Questions

What is the rental rate?

Rental rate. the periodic charge per unit for the use of a property. The period may be a month, quarter, or year. The unit may be a dwelling unit, square foot, or other unit of measurement.

How much should my rent be Dave Ramsey?

Your rent payment, including renters insurance (more on that later), should be no more than 25% of your take-home pay. That means if you're bringing home $4,000 a month, your monthly rent should cost you $1,000 or less. And remember, that's 25% of your take-home pay—meaning what you bring in after taxes.

What is the 50 30 20 rule?

Those will become part of your budget. The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

What is the rule of thumb for rent?

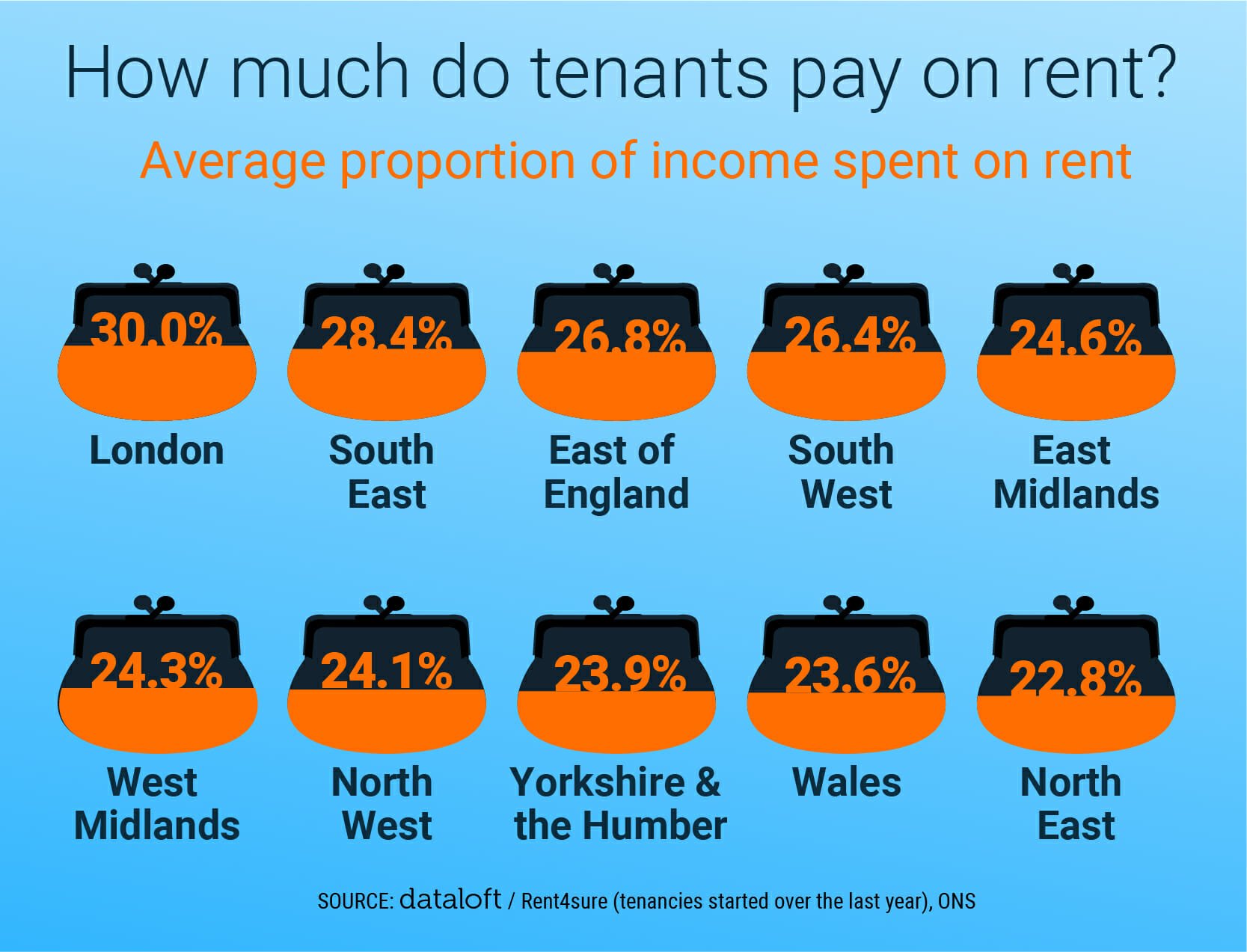

A popular standard for budgeting rent is to follow the 30% rule, where you spend a maximum of 30% of your monthly income before taxes (your gross income) on your rent. This has been a rule of thumb since 1981, when the government found that people who spent over 30% of their income on housing were "cost-burdened."

FAQ

- How do you calculate rental rate?

- The rental rate for a property typically ranges between . 8%–1.1% of the home's current market value. For a property valued at $200,000, the rent could range between $1,600–$2,200 a month. When you use this method to calculate a rental rate for your property, take the price range of the property into account.

- Is rental income worth it?

- Investing in a rental property is a great way to generate steady, ongoing income. And if you hold on to a rental property for many years, it could appreciate quite nicely in value over time. But investing in real estate isn't the same thing as investing in assets like stocks.

- Is 3000 rent too much?

Following the 30% rule might look something like this: If your gross income is $10,000 per month: You can afford a $3,000 monthly rent. If your gross income is $6,667 per month: You can afford a $2,000 monthly rent. If your gross income is $5,000 per month: You can afford a $1,500 monthly rent.

- How do you calculate rental income from a property?

Use the One Percent Rule. If you cannot obtain actual figures for a potential property, you can use the one percent rule of rental real estate to determine cash flow. Simply put, a property's rental rate should be at least 1% of the total property value. For a $200,000 property, rental income should at least be $2,000.

How much rent will i pay for this house

| How do you calculate rent per day? | It works like this: take the monthly rent and multiple it by 12 to find the total yearly rent. Then divide the sum by 365 to determine the daily rent. Once you find the daily rent, you multiply it by the number of days the tenant will occupy the unit. |

| How do I calculate the selling price of my house? | 4 Steps to Know How Much Your Home Is Worth

|

| What is the average US home selling price? | Basic Info. US Existing Home Median Sales Price is at a current level of 394300.0, down from 404100.0 last month and up from 383500.0 one year ago. This is a change of -2.43% from last month and 2.82% from one year ago. |

- What is the best price for selling a house?

Most home sellers will get the best results if they set their asking price within 5% of what target buyers would consider to be the fair market value of the property.

- What is the average price of a house in Mississippi?

$176,568. The average Mississippi home value is $176,568, down 1.4% over the past year and goes to pending in around 15 days.

- How accurate is Zillow Zestimate?

The nationwide median error rate for the Zestimate for on-market homes is 2.4%, while the Zestimate for off-market homes has a median error rate of 7.49%.