SEO Meta Description: Curious about real estate record-keeping? Discover how long you should retain important documents to ensure compliance and protect your interests as a homeowner in the US.

Introduction

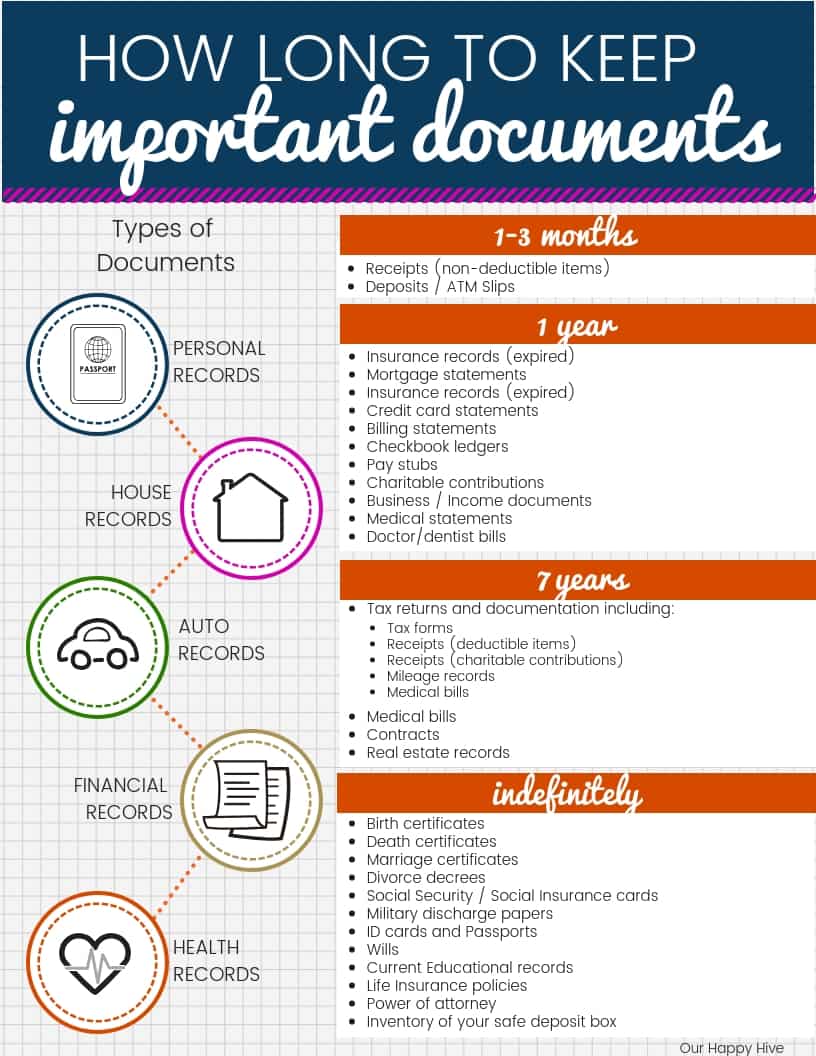

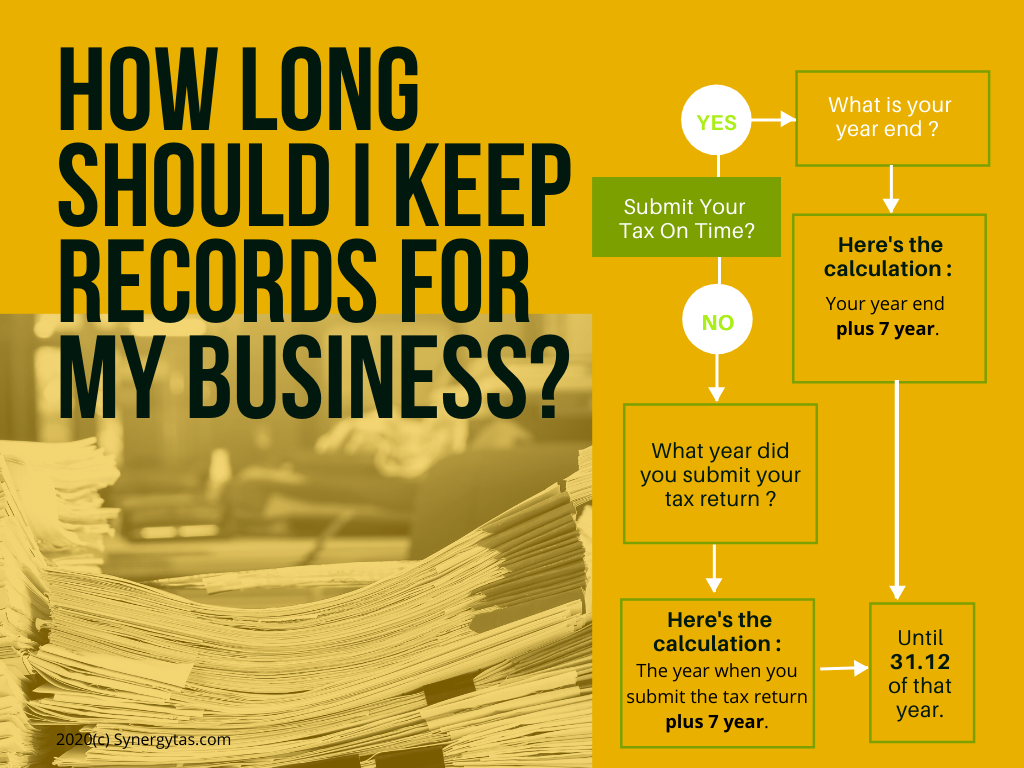

When it comes to real estate, keeping track of paperwork is not only essential for organization but also crucial for legal and financial purposes. As a homeowner in the US, you may wonder, "How long do I need to keep real estate records?" In this comprehensive guide, we will delve into the recommended retention periods for various real estate documents, helping you stay organized and compliant.

Understanding the Importance of Real Estate Record-Keeping

Proper record-keeping safeguards your rights and interests as a homeowner. Whether it's for tax purposes, insurance claims, or potential legal issues, having access to accurate and up-to-date documentation is vital. It helps you track property improvements, monitor mortgage payments, and provide evidence in case of disputes or audits.

How Long Should I Keep Real Estate Records?

- Purchase Documents a. Closing Disclosure: Keep this document indefinitely, as it provides a detailed breakdown of your mortgage loan. b. Settlement Statement: Retain this document for at

Real estate records how long to keep

When it comes to managing real estate, keeping track of important documents is crucial. Knowing how long to keep these records can save you time, money, and potential legal hassles. In this guide, we will explore the benefits and conditions for using the real estate records how long to keep.

I. Understanding the Importance of Real Estate Records:

- Real estate records serve as proof of ownership, transactions, and legal compliance.

- They can be crucial when applying for loans, filing taxes, or resolving disputes.

- Keeping organized records ensures a smooth property transfer process.

II. Benefits of Knowing How Long to Keep Real Estate Records:

- Legal Compliance:

- Avoid potential penalties or legal issues by adhering to record retention requirements.

- Protect yourself from potential lawsuits, as proper documentation serves as evidence.

- Financial Management:

- Accurately track property-related expenses, tax deductions, and investments.

- Provide a clear financial history for lenders, investors, or potential buyers.

- Efficient Record-Keeping:

- Streamline property management by maintaining an organized record system.

- Easily access essential information when needed, saving time and effort.

III. Recommended Timeline for Real Estate Records:

- Deeds

How long keep real estate records

Testimonial 1: Name: Sarah Thompson Age: 34 City: Los Angeles, CA

I cannot express enough how grateful I am for the information I found when searching for "how long keep real estate records." As a first-time homeowner, I was completely clueless about how long I needed to keep all the paperwork related to my property. Thanks to this search, I stumbled upon a fantastic article that answered all my questions in a clear and concise manner. Now I feel much more confident and organized, knowing exactly how long to keep real estate records. Kudos to the writer for simplifying such a complicated topic!

Testimonial 2: Name: Robert Johnson Age: 45 City: New York City, NY

I have been in the real estate business for over two decades, and even I was unsure about the proper duration to keep real estate records. After a quick search for "how long keep real estate records," I stumbled upon a fantastic resource that not only provided a detailed explanation but also gave practical tips on organizing and storing these important documents. The article's light-hearted and arbitrary writing style made it an enjoyable read, which is quite rare when it comes to legal matters. I would highly recommend this resource to anyone in the real estate industry

Should you keep your closing documents forever?

How long should you keep documents relating to real estate?

How long should you keep documents relating to the purchase and sale of real estate?

My people,

— Dr. N. T. A. Azeez (@adegokegalaxy) October 17, 2020

You see this our elder brother is from Ogbomoso.

Almost every Nigerian condemned the debacle in Ogbomoso. He kept quiet.

One day, he would want to contest for House of Rep in the same Ogbomoso.

Egbon, we are keeping our records. Just to inform you. https://t.co/mDcOQxEyJs